Executive Summary

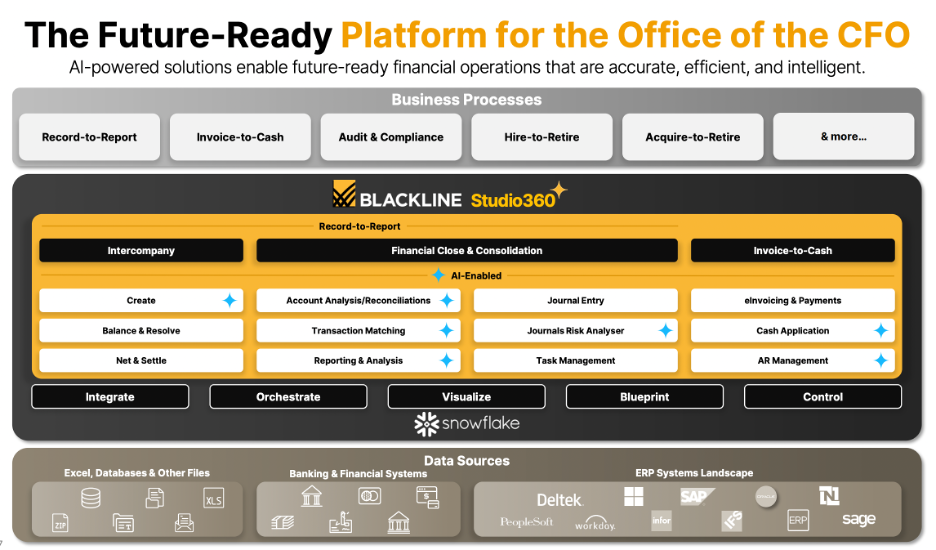

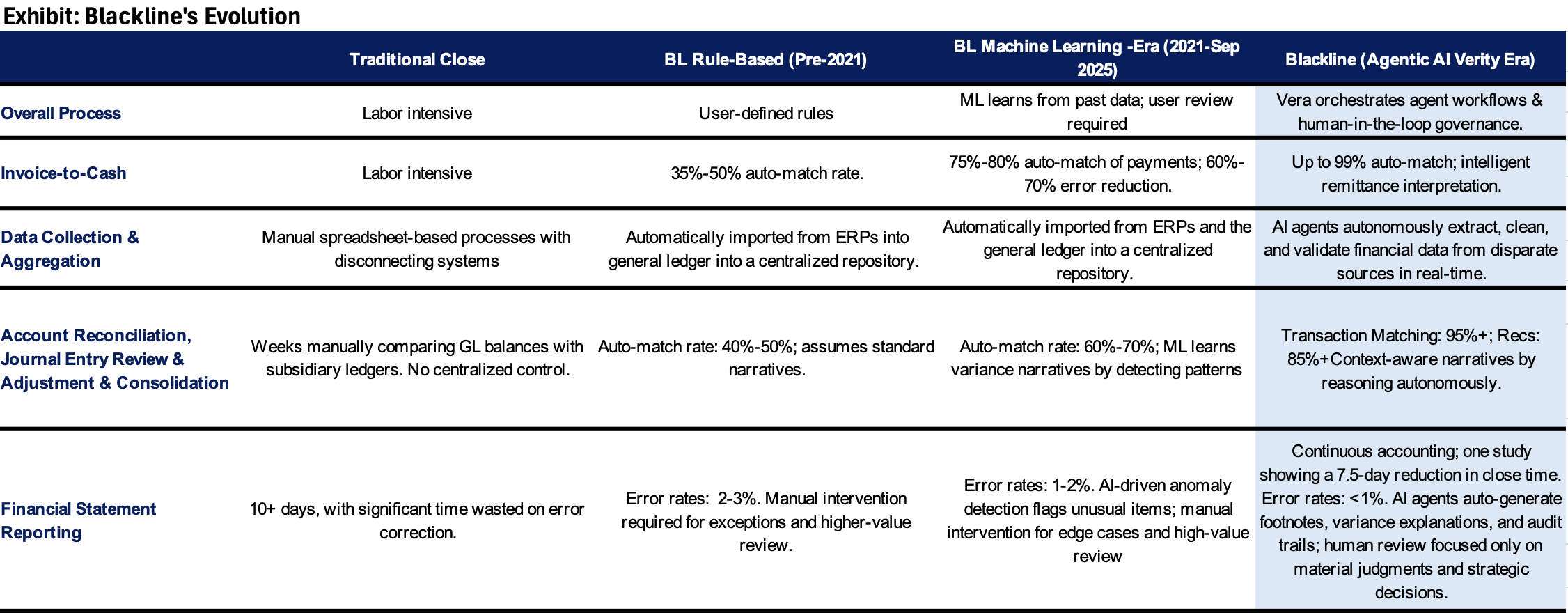

BlackLine operates a purpose-built, ERP-agnostic SaaS platform designed to modernize the Office of the CFO. While enterprise resource planning (ERP) systems record transactions, they lack workflow automation to verify them. BlackLine fills this critical gap by automating account reconciliations, transaction matching, and variance analysis—transforming what would otherwise be weeks of manual spreadsheet work into a centralized, audit-ready process.

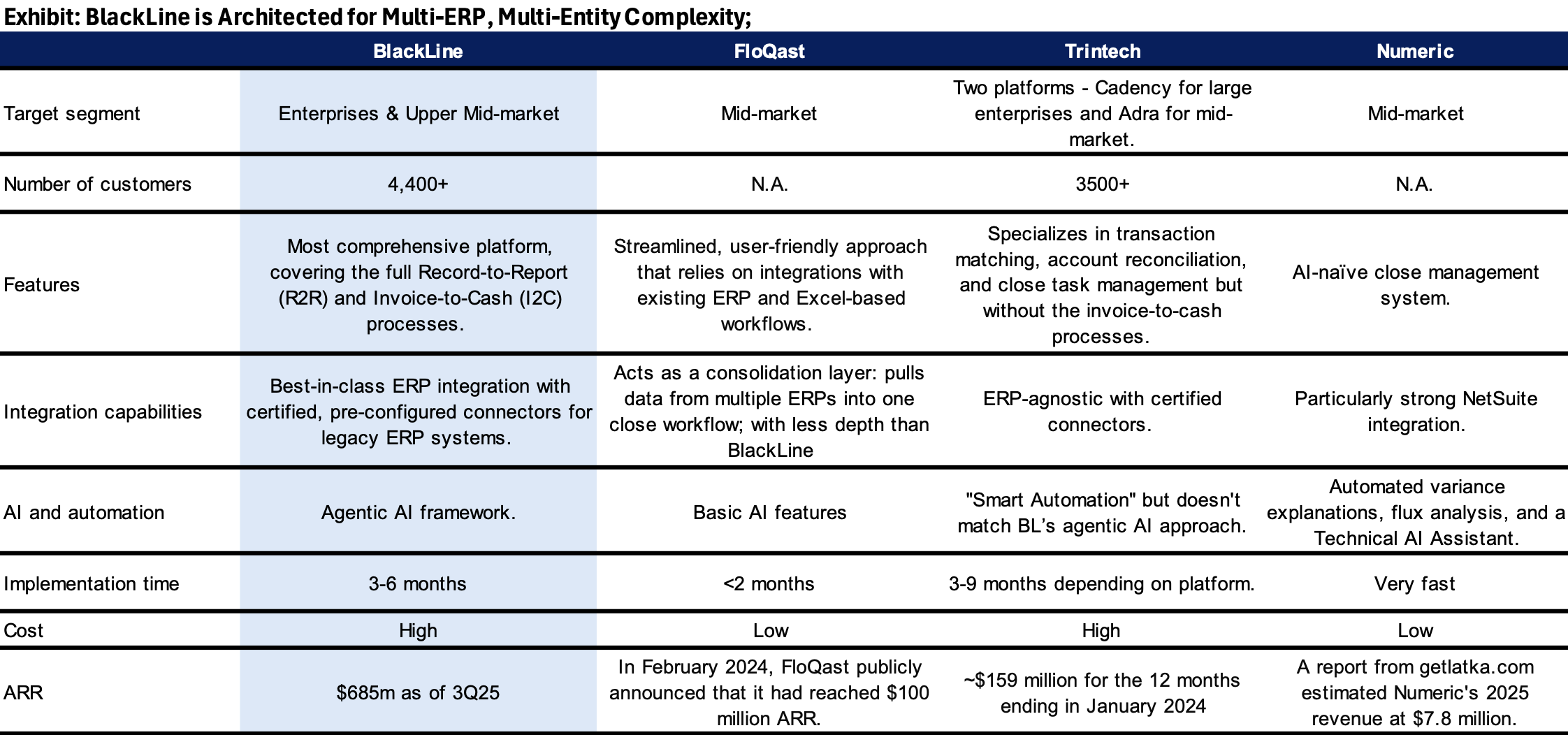

BlackLine has deliberately shifted from chasing customer volume to pursuing profitability with discipline. The company is (a) focusing resources on large enterprises ($750M+ revenue) and upper mid-market, while (b) exiting lower-margin mid-market segments where competitors (FloQast, Trintech Adra) offer faster, cheaper alternatives.

BlackLine's enterprise dominance rests on three defensible moats — high switching costs, 20-year proprietary data lead (AI Data Moat), and its unique status as the "Switzerland" of finance in multi-ERP environments with complex transactions. However, these defenses have yet to translate into shareholder alpha due to historic inefficiency and slowing NRR. The critical question: Can AI agent-driven productivity gains (claimed 50%+ efficiency improvement) justify sustained ARR increases wthinin its enterprise segment.

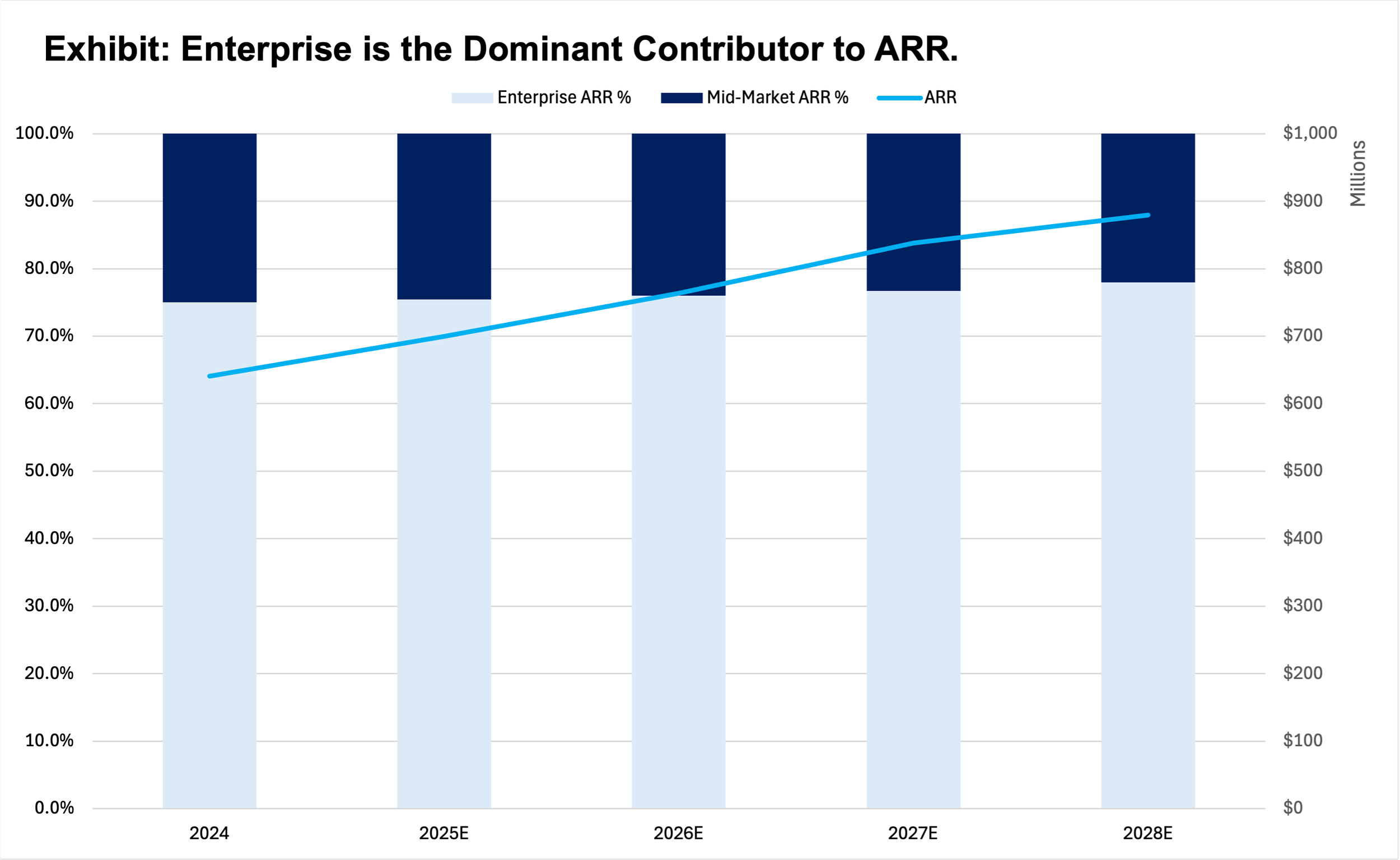

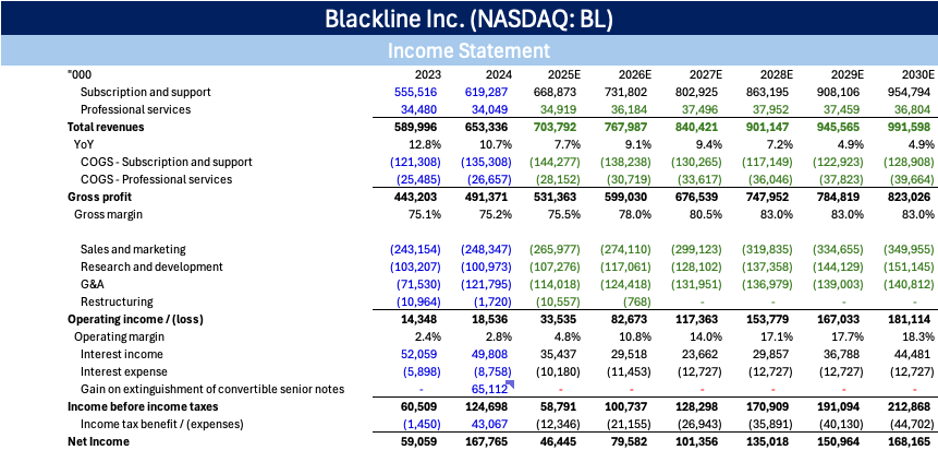

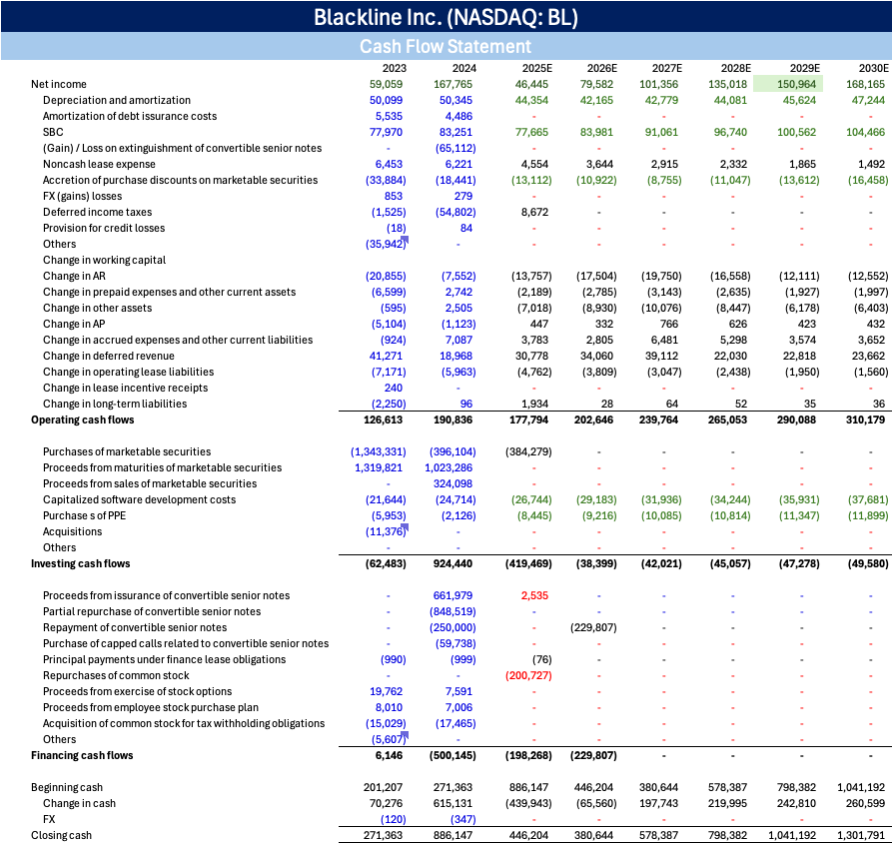

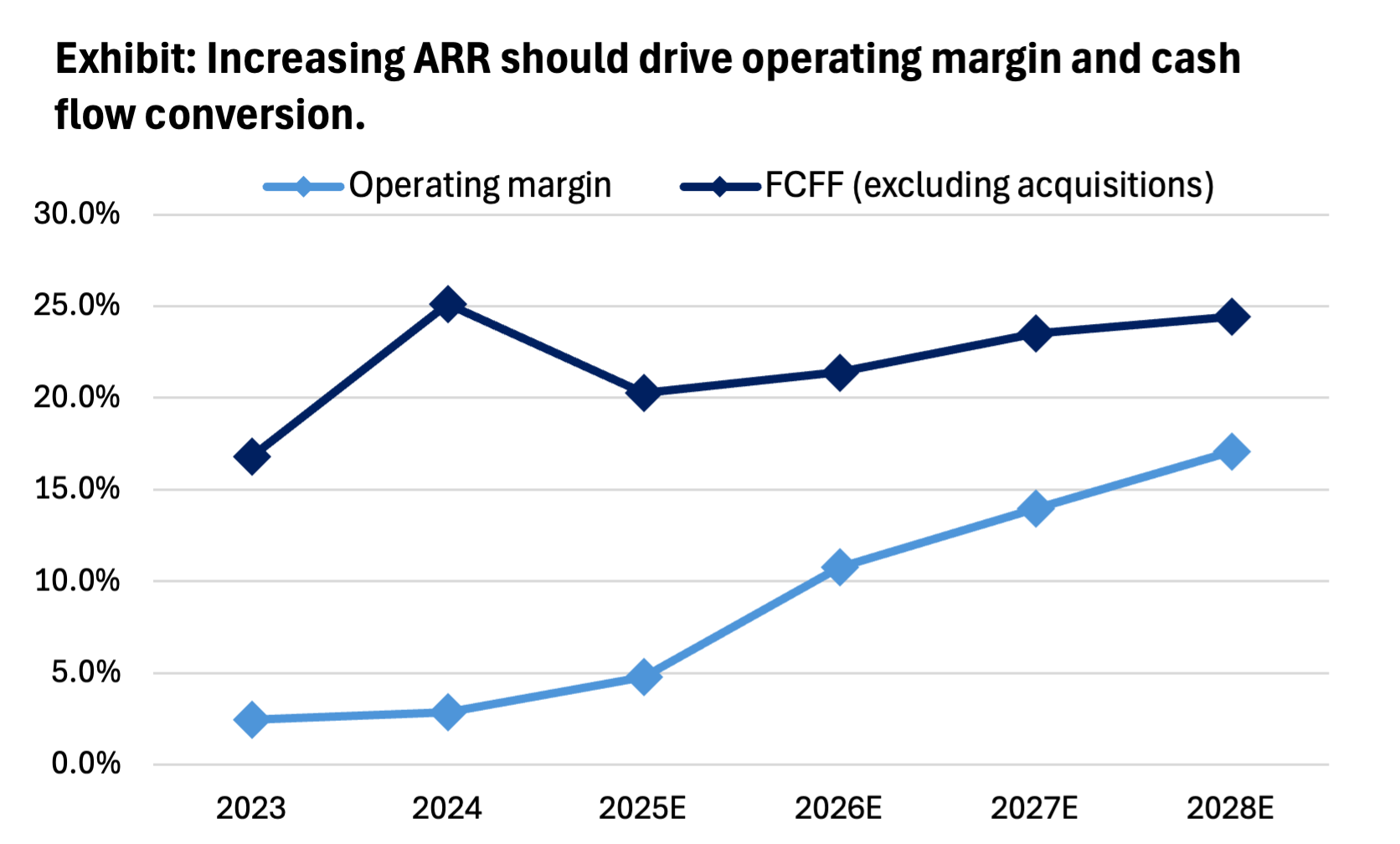

I am forecasting ARR to expand at 7% (v.s. management’s 13%-16%), driven by an increase contract value per customer of 8%, partially offset by a 1% drop in total customers. Despite modest revenue growth, profitability expands meaningfully: Net income grows from $46M (2025E) to $168M (2030E) due to exit in low margin customers and operating leverage from platform pricing model.

Price target of $44, (-23% price drop from the current $57.53), implying an EV/2026E Revenue of 3.65x. Price target is also 33% below SAP’s non-public offer of $66 per share which Blackline rejected in June 2025. Our base case reflects a slower-growth, higher-margin trajectory that better accounts for competitive pressures.

Business Model

BlackLine operates a purpose-built, ERP-agnostic SaaS platform designed to modernize the Office of the CFO. While enterprise resource planning (ERP) systems record transactions, they lack workflow automation to verify them. BlackLine fills this critical gap by automating account reconciliations, transaction matching, and variance analysis—transforming what would otherwise be weeks of manual spreadsheet work into a centralized, audit-ready process.

Unlike competitors such as OneStream that often aim to displace legacy Corporate Performance Management (CPM) systems, BlackLine sits between the ERP and the final reporting layer. This positioning makes BlackLine complementary to existing ERP ecosystems rather than competitive. Consequently, ERP incumbents like SAP actively resell BlackLine as a 'default' Solution Extension (SolEx) to de-risk and accelerate finance transformation.

Customer segmentation & revenue mix - strategically prioritizes upper mid-market and enterprise clients, a focus that is reflected in its revenue composition.

Enterprise dominance. While enterprise customers represent approximately 50% of the total customer base, they generate ~75% of ARR.

Mid-Market accounts for the remaining 50% of customers but contributes only ~25% of ARR.

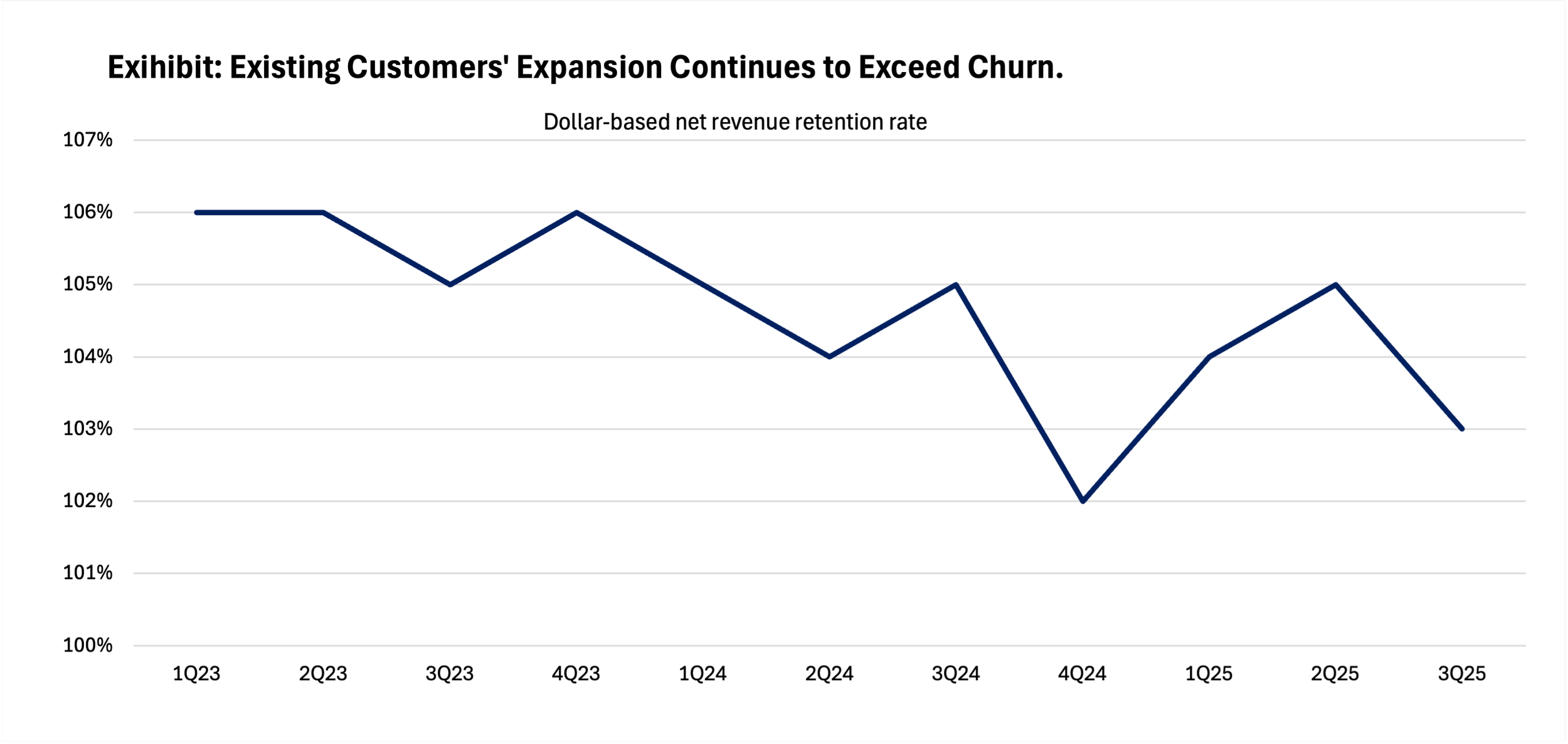

NRR indicates exiting customers’ expansion continues to exceed churn but with an important caveat. Retention rates are significantly higher within the enterprise cohort compared to the mid-market, driving the company’s ongoing strategic resegmentation to focus on higher-value, lower-churn accounts. 2Q25 mid-market renewal rates were in the 80s.

Multi-channel distribution anchored by its ecosystem of partners.

Direct & partner sales through technology vendors, professional services firms (SIs), and business process outsourcers (BPOs).

Cloud marketplaces. Solutions are transactable via major cloud marketplaces, including Google Cloud Platform (GCP), Microsoft Azure, and AWS, reducing friction in procurement.

The SAP Partnership ("SAP SolEx") represents strategic importance, contributing ~26% of total revenue. The partnership was "reinvigorated" in 2025 and is aggressively bundled in the sales motion during the SAP migration. Despite serving over 1,200 SAP customers, market penetration remains low at ~3.3% of the 30,000 SAP customers in BlackLine's Ideal Customer Profile (ICP).

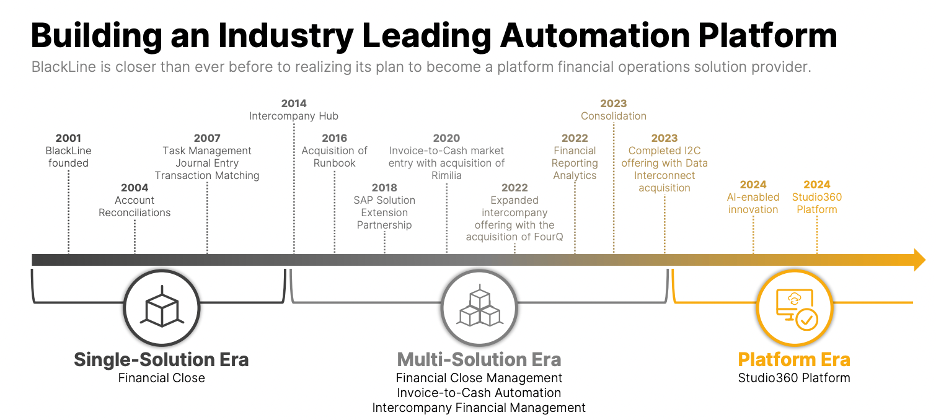

Product expansion strategy. BlackLine historically expanded its product offerings and strengths its ecosystems through organic development and targeted acquisitions in adjacent verticals.

Invoice-to-Cash (Rimilia): Acquired in Oct 2020, this AI-powered platform automates accounts receivable (AR) and cash application, moving BlackLine beyond the financial close.

Intercompany Financial Management (FourQ): Acquired in Jan 2022, FourQ automates complex intercompany accounting and tax processes, addressing a major pain point for multinational enterprises.

Electronic Invoice Presentment & Payment (Data Interconnect): Acquired in Sep 2023, this UK-based strategic tuck-in enhances AR automation and EIPP capabilities.

AI Agents for Subjective Workflow (WiseLayer). Acquired in Dec 2025, WiseLayer builds AI agents specifically designed for judgment-based finance tasks.

New market entry into public sector. In August 2025, BlackLine announced its first federal agency deal, marking its formal entry into the public sector. While the first federal win validates the technology, the finite universe of federal agencies limits the 'volume' upside. Key value within this vertical is the credibility that it creates for private enterprises rather than a primary driver of topline acceleration.

Key Strategies

BlackLine has pivoted its customer acquisition strategy to prioritize the "Rule of 40" over-growth at all costs. The company is intentionally shedding smaller, lower-value mid-market accounts to focus resources on the Enterprise ($750M+ revenue) and Upper Mid-Market sectors.

Pricing model evolved from seats to platform + consumption based. Legacy seat pricing discouraged adoption (customers limited user counts to save costs). The new model encourages broad deployment while monetizing transaction volume and modules utilized. In Q3 2025, nearly 75% of new bookings used the new pricing model. This structural shift drove average new deal sizes up 111% YoY, proving that enterprise customers are willing to pay premiums for broader platform access.

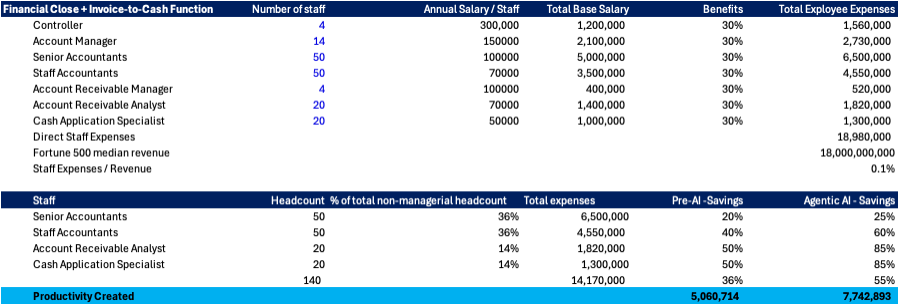

From faster to autonomous. Agentic AI suite (launched late 2025) introduces "Vera," an AI agent that orchestrates complex workflows. BlackLine’s agents perform execution tasks—autonomously drafting variance narratives, cleaning data in real-time, and interpreting unstructured remittances (PDFs/emails) with up to 99% accuracy.

The new strategy is visibly altering the bookings mix, favoring fewer but significantly larger land deals. YTD Bookings are up 15%, with management guiding to ~20% growth for FY2025. Management noted that "roughly half" of the booking strength is attributable to longer lease terms (multi-year deals).

New customer bookings surged 45% YoY entirely driven by deal size (+111% YoY) rather than volume (deal count dropped ~31%). This confirms BlackLine is closing fewer, massive deals rather than chasing volume.

Existing Customer’s Net Revenue Retention (NRR) at 103%. While churn remains present (~7% annualized, primarily mid-market), this churn was fully offset by a ~10.8% expansion among retained customers (implied from 103% NRR). Plus tthe renewal rate for Q3 2025 was 93%, driven by healthy enterprise performance in the upper 90s and middle market performance in the mid-80s, validating the stickiness of the new platform model for core customers.

Industry Analysis

Most finance teams do not yet use specialized close software. They rely on core ERP modules (for GL entries and consolidation) supplemented by a fragmentation of Excel spreadsheets, email chains, and shared drives to manage the close process. For many organizations, "good enough" manual processes remain the key norm.

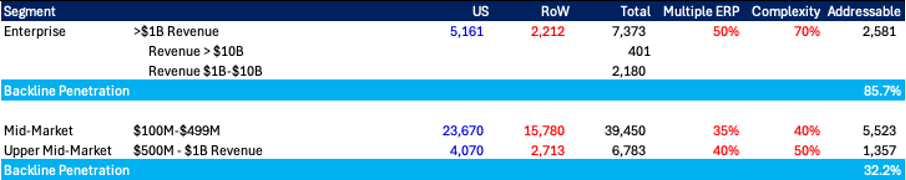

Management cites a $45B+ TAM which Blackline has low penetration. I think the low penetration after years and a 'reinvigorated' partnership suggests either the TAM is irrelevant or the product lacks moats. If the moat was truly defensible, penetration should be 15-30% by now. The low penetration suggests the product-market fit is weaker than management claims in that segment.

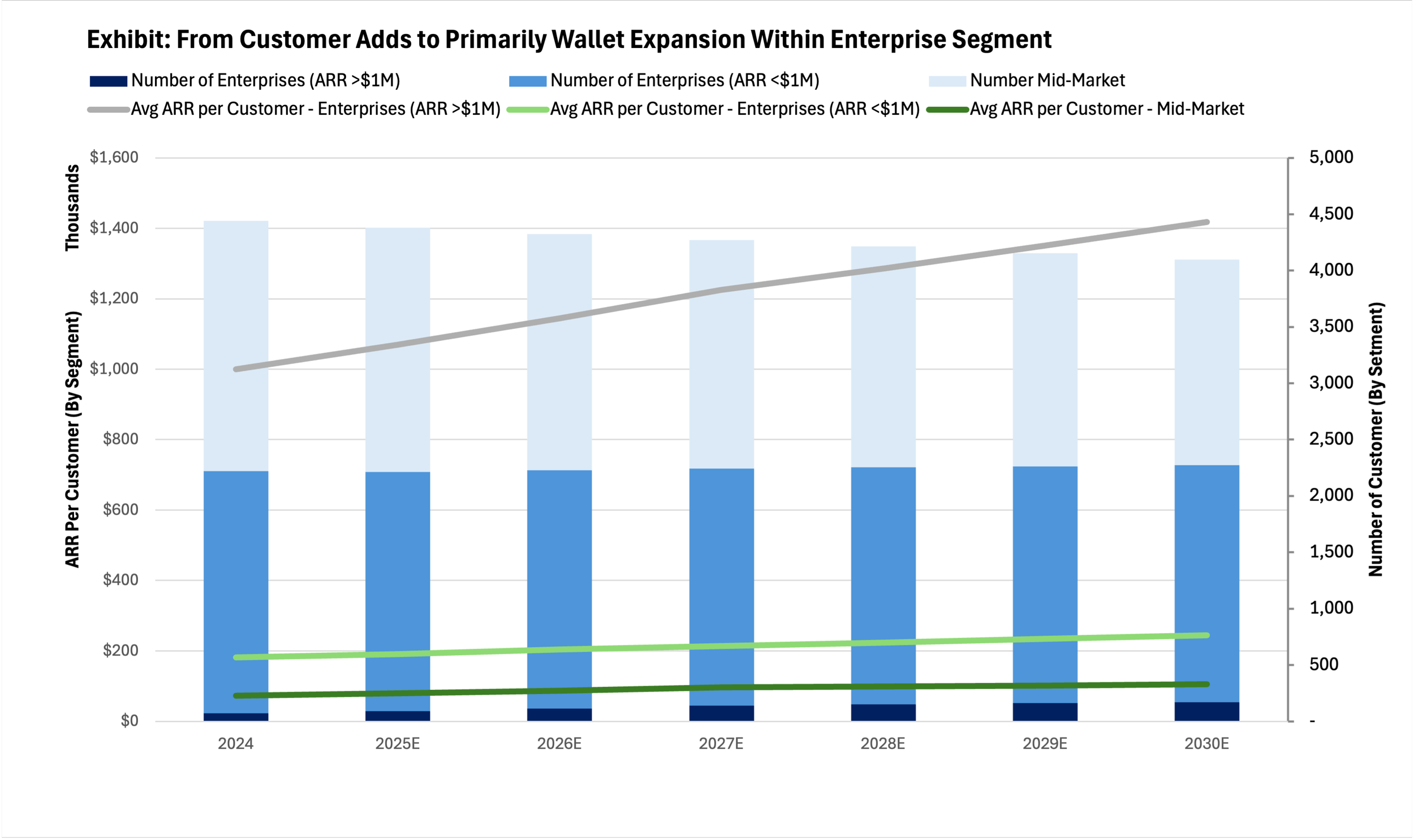

Applying a more granular "strategic TAM" analysis reveals a different reality - BlackLine is already deeply penetrated in the enterprise segment. The primary growth runway is no longer just logo acquisition—it is wallet share expansion. The strategy hinges on graduating the ~2,100 'standard' enterprise customers (ARR <$1M) into the >$1M tier. This dynamic is visible in the data: while the total enterprise customer count remained flat (2,222 at YE24 vs. 2,212 at Q3 25), the number of >$1M ARR customers surged, confirming that growth is now being driven by 'Land & Expand' rather than 'Land & Land”.

Mid-market will continue to struggle. In the mid-market ($50M-$500M revenue), BlackLine is likely ceding share to agile competitors like FloQast and Trintech (Adra) due to its inherent complexity—implementation cycles often exceed 3-6 months with higher service costs, compared to <2 months for lighter rivals like FloQast. Simpler organizations find better "product-market fit" with tools that offer faster Time-to-Value (TTV) and lower Total Cost of Ownership (TCO).

Value Proposition

BlackLine addresses a massive, enduring pain point: even in 2025, finance teams at mid-sized and large enterprises rely on a fragmentation of spreadsheets to finalize their books. ERPs record transactions, but they don't verify them. BlackLine fills this void by automating the "messy middle"—account reconciliations, transaction matching, and variance analysis—providing the visibility and audit trails that spreadsheets lack.

Despite BlackLine’s high return metrics, its struggle to penetrate the mid-market exposes a fundamental misalignment of product-market fit. Customers in this segment often view an enterprise-grade 'close suite' as overkill, preferring lighter, faster-to-deploy alternatives (like FloQast) or simply sticking to low-cost Excel workflows.

Creates the greatest value for companies with complex transaction environments, such as those with global subsidiary structures and multiple ERP systems—these are the customers within BlackLine's enterprise TAM.

Business Moats

High switching cost. Because the cost of failure is existential, enterprises are extremely risk averse. Once BlackLine is validated by auditors and integrated into the control framework, displacing it for a cheaper rival is a career risk for any CFO. This is quantified by the 96% Gross Renewal Rate in the enterprise segment.

Data moat. BlackLine has processed billions of transaction matches and variance explanations over 20 years. This proprietary dataset trains its agents (Verity) to understand context. While new entrants can build a "matching engine," but they lack the historical edge cases to train an AI on complex transactions. BlackLine’s agents improve with every user interaction, creating a moving target that generic LLMs or startup competitors cannot easily replicate. This is particularly valuable where transactions are complex.

The Switzerland Factor. Large enterprises are fragmented across multiple ERP. but incumbent ERPs are incentivized to create walled gardens, not bridges. Building seamless connectors to competitors would commoditize their own core ledgers. This structural conflict leaves the cross-platform "interoperability layer" wide open for BlackLine to dominate.

The moats are defensible within its enterprise segment as evidenced by its 85%+ market penetration , but the company has historically failed to translate this dominance into "excess returns" (shareholder alpha) due to its growth at all costs strategy. The investment thesis hinges on whether the new AI-driven value prop can monetize this moat by expanding wallet share. Until NRR accelerates, the moat protects the downside but hasn't yet unlocked the upside within its enterprise segments.

Mid-market will continue to struggle. In the mid-market ($100M-$750M revenue), BlackLine is likely ceding share to agile competitors like FloQast and Trintech (Adra) due to its inherent complexity—implementation cycles often exceed 3-6 months with higher service costs, compared to <2 months for lighter rivals like FloQast. Simpler organizations find better "product-market fit" with tools that offer faster Time-to-Value (TTV) and lower Total Cost of Ownership (TCO).

Growth Drivers

My forecast diverges from management’s optimistic 13-16% target, modeling a more conservative 7% Revenue CAGR (2025E–2030E), primarily reflecting my view that (1) penetration within enterprise segment is high and (2) the mid-market "churn drag" due to misalignment in product fit. Supported by the 3Q25 Pipeline up 50% YoY, adjusting for longer terms and 20% conversion and normalized chur rate, this translates to mid-single digit ARR growth base rate in my forecast.

"Mega-Enterprise" Proxy (ARR > $1M): Primary growth vector with the number of >$1M ARR customers to nearly double from 83 (Q3 2025) to 168 (2030E), with ARR expanding 7% in 2026E and 2027E due to change to platform pricing and 5% from 2028E to 2030E to reflect price uplift driven by AI Value Capture modeled at ~5% annual increase as customers pay for "digital workers" (agents) rather than human seats.

Mid-Market (<$750M ARR. Customers to shrink from 2,212 (Q3 '25) to 1,823 (2030E), partially offset by high ARR due to customer mix.

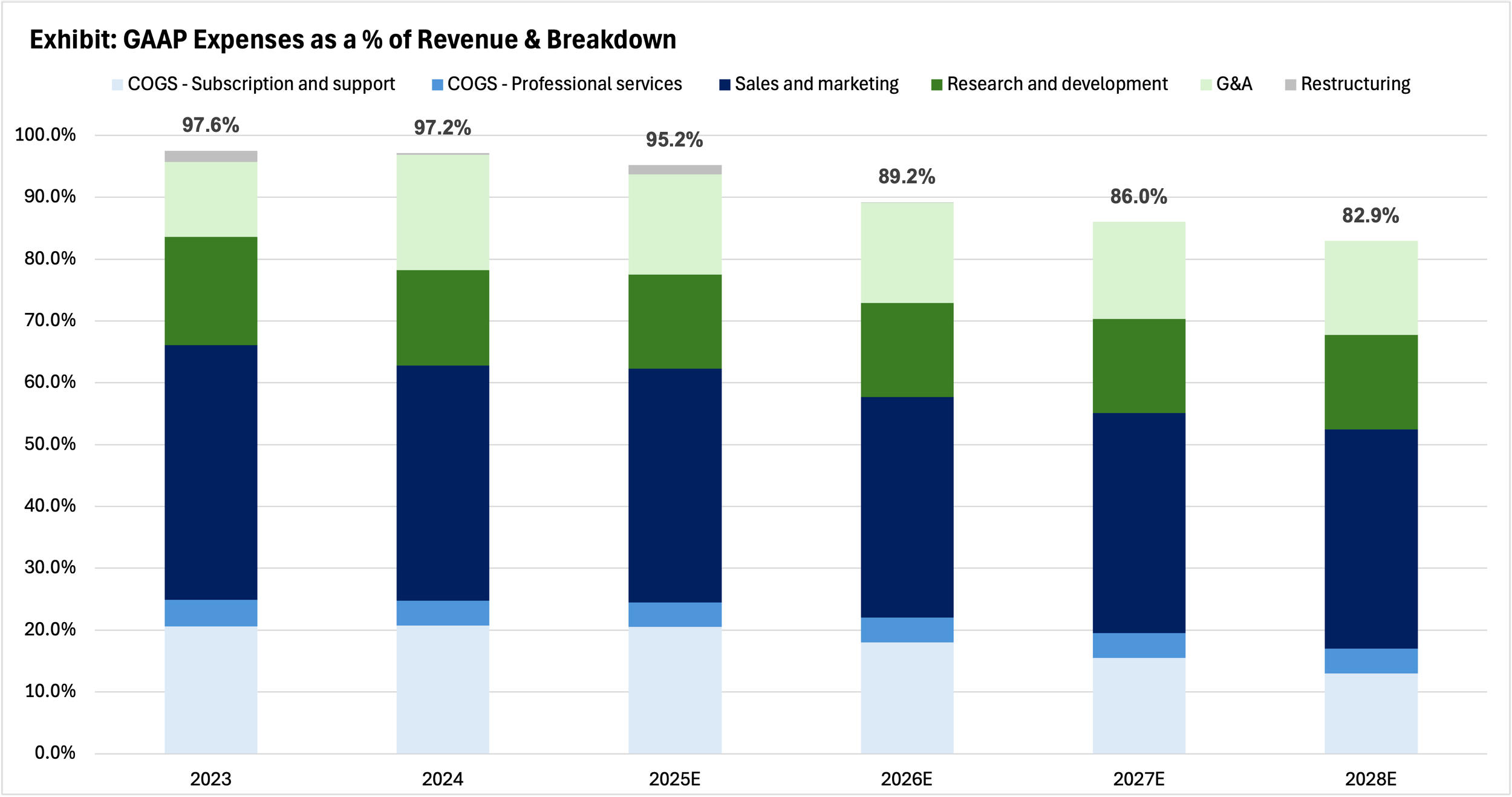

Operating Leverage. GAAP operating margins to expand from 2.8% in 2024 to 18% in 2030E, while cash flow generation expand from 20% in 2025E to 26% in 2030E.

Valuation

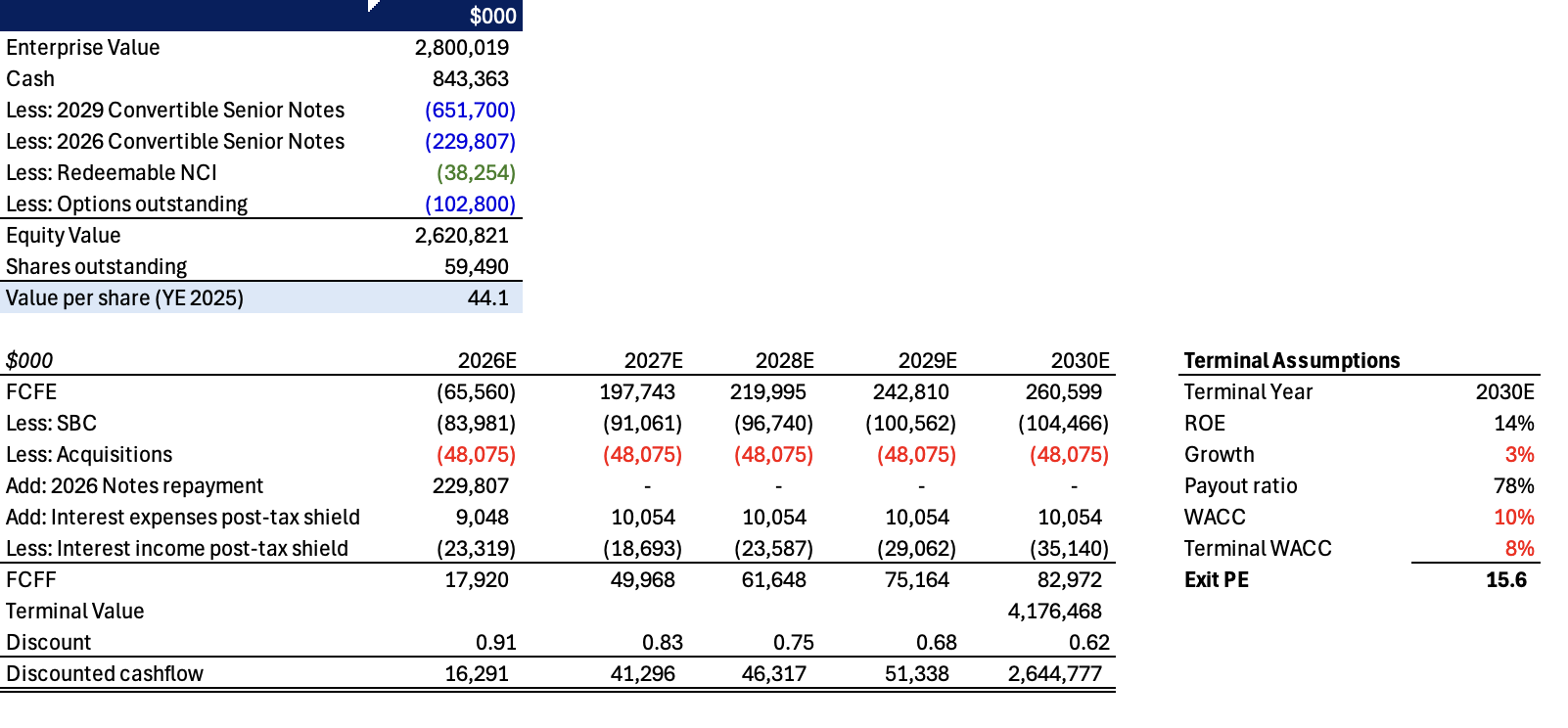

$44.00 price target (YE 2025) using a Discounted Cash Flow (DCF) analysis based on an Unlevered Free Cash Flow (FCFF) approach. (Note: included acquisitions amount based on 2019-2024 average as acquisitions seems to be a key part of the management strategy.) This methodology isolates the value of BlackLine’s core operations and explicitly accounts for its capital structure, including the net impact of its significant cash balance and convertible debt obligations.

Price target of $44, (-23% price drop from the current $57.53), implying an EV/2026E Revenue of 3.65x. Price target is also 33% below SAP’s non-public offer of $66 per share which Blackline rejected in June 2025.

Our base case reflects a slower-growth, higher-margin trajectory that better accounts for competitive pressures.

Key Investment Risks

AI moats are fragile compared to traditional moats.

Enterprises use AI agents to reduce the number of transactions they process and result in unit volume shrink.

Mid-market churn accelerates due to misalignment in product fit + competitors catching up in AI agents within less complex environment.