Business Model

Kuaishou Technology is the second largest Chinese social-commerce platform that combines short-form video and live streaming with a decentralized recommendation algorithm, fostering authentic creator-viewer interactions. Leveraging its massive user base and trust-driven e-commerce model, the company monetizes through live gifting, targeted advertising, and integrated shopping experiences.

Platform evolution. Kuaishou started as a short-video platform in 2011 as a GIF tool, pivoted to short videos in 2013, initially monetized through live streaming, then expanded into advertising, and recently accelerated its e-commerce growth that was launched in 2018.

User Engagement and Growth Metrics. As of Q2 2025, Kuaishou maintains strong user engagement with 409 million average daily active users (DAUs) and 715 million monthly active users (MAUs), representing growth of 3.4% and 3.3% YoY respectively. Users spend an average of 127 minutes daily on the platform as of Q2 2025.

Kuaishou adopts a decentralized algorithm and inclusive traffic distribution. This decentralized approach creates more varied, "grassroots" content that focuses on real-life and lifestyle streaming. Every new creator—regardless of follower count—has a chance to reach viewers, which resonates strongly with users who are more likely to connect with relatable, non-celebrity content creators. The merchants who succeed tend to be smaller businesses offering daily-use items—groceries, skincare, household goods—rather than high-end luxury or fast-fashion brands common on more urban-focused platforms.

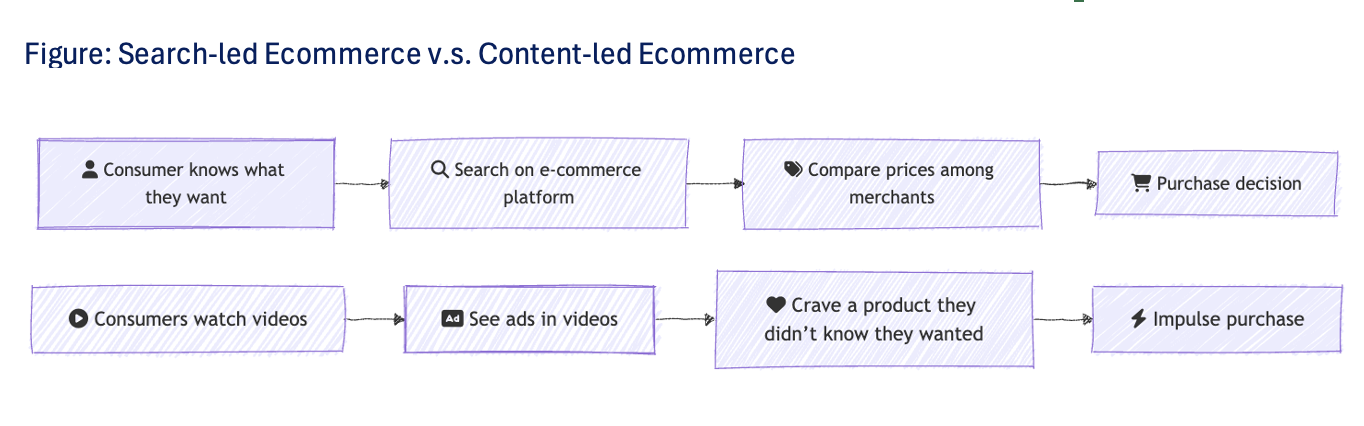

Omnichannel E-Commerce Strategy. Pan-shelf GMV has expanded slowly as a % of total GMV. Yet majority of the GMV was still through content based scenarios. In 2Q25, pan-shef (search-led catelog) accounted for 32% of GMV.

AI Innovation through Kling AI. Kling AI represents a significant new revenue stream and could provide a new channel to increase user engagement time. Launched in June 2024, Kling AI generated over RMB 150 million in revenue in Q1 2025, surpassing expectations, and over RMB 250 million in Q2 2025. The recent Kling AI 2.5 Turbo model achieved nearly 30% cost reduction while maintaining top-tier performance, according to Goldman Sachs.

Monetization. Kuaishou monetizes through three primary segments as of Q2 2025.

Online marketing revenue Targeted ads across the platform through performance and brand advertising sold via auction (CPC/CPM/oCPX) across two sub-channels: external marketing (off-platform outcomes like app installs, mini-games, short plays) and closed-loop marketing (in-app e-commerce conversions measured to GMV/ROAS).

Live streaming. Revenue generated when viewers buy virtual items and gift them to creators, with the platform keeping a share. Q2 2025 live streaming revenue reached RMB 10.045 billion.

Other services (Primarily e‑commerce & Kling AI)— Primarily e-commerce through shelf-based, search, short-video and live-streaming commerce where it earns commissions on transactions and merchant service fees (traffic tools, operations services), plus value-added services around fulfillment, payments, and guarantees. Incremental contribution from Kling AI through paid subscriptions and usage-based/API fees.

Executive Summary

Kuaishou Technology is the second largest Chinese social-commerce platform that combines short-form video and live streaming with a decentralized recommendation algorithm, fostering authentic creator-viewer interactions. Leveraging its massive user base and trust-driven e-commerce model, the company monetizes through live gifting, targeted advertising, and integrated shopping experiences.

Kuaishou’s flywheel effect leverages short videos to attract users, monetizes engagement through live streaming, expands content and user base, unlocks advertising services, and drives e-commerce conversions via trust-based creator relationships.

Kuaishou’s content leadership differentiates it from traditional search-led e-commerce and allows it to compete against tech giants without engaging in price competition.

Kuaishou offers a unique value proposition for users, streamers, and merchants: authentic, relatable content via decentralized algorithms; a low-cost monetization ecosystem for creators; and an interest-ecommerce model that drives impulse purchases while reducing direct price competition.

Kuaishou’s wide business moats stem from its algorithmic “followers-first” approach, scale-driven network effects, high switching costs, and continuous AI-powered innovation, creating a self-reinforcing ecosystem that competitors find costly and complex to replicate.

Kuaishou can sustain a continuous influx of high-quality videos and live streams, underpinning long-term user engagement and growth by lowering content production barriers through AI tools like Kling AI. Sustained ad spends shifting to video (72% → 80% share by 2030E), improving e-commerce conversion rates (from 18% baseline to ~25%), rising incomes, and expanding margins underpin Kuaishou’s durable growth trajectory.

Initiate with Buy rating. Intrinsic value of $112 per share by YE25, representing 44% upside from current levels of $78 and reflecting the bullish thesis on the future of short video industry and the company's operational execution and market positioning.

Industry Analysis

Segment 1: Short Video & Live Streaming Industry

China mobile internet users increased 77% between 2015 and 2024. China’s mobile internet user base grew from approximately 620 million in 2015 to over 1.1 billion in 2024, with penetration rising from 45.3% to 78.6%, representing 99.7% of all internet users.

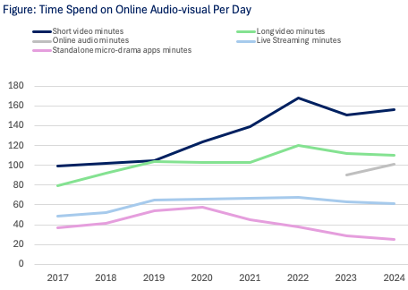

Short video has achieved near-ubiquity. 94% of internet users engage with short-form clips—while live streaming reaches 75% of users. Online audio-visual daily usage rose from 4 hours in 2017 to 8 hours in 2024, driven primarily by short video consumption, in-line with average daily live streaming sessions increasing to 117.9 per user, indicating micro-moment consumption patterns. Future growth in short video will depend on continued content creation to boost daily browse time, whereas live streaming growth will be driven by deeper penetration among remaining non-streaming users.

Users’ engagement preference towards short video format. Short video has been the most popular online audio-visual segment since 2019, followed by live streaming (833 million users), long video (752 million), short series (662 million), and online music (335 million) in 2024. Users dedicate an average of 156 minutes daily to short video, intensifying competition for attention going forward.

Duopoly short video market. Douyin and Kuaishou together command over 90% of the live streaming market and 70%+ of the short video market. As of December 2024, Douyin reported 978 million MAUs and 587 million DAUs, while Kuaishou’s MAUs exceeded 500 million, confirming their duopoly in short-form content.

Monetarization Evolution. Both platforms initially prioritized user acquisition over monetization, then leveraged live streaming starting in 2016 as the primary revenue driver. Live streaming platforms traditionally earn via virtual gifting and incremental ad insertions tied to real-time broadcasts.

With the gift economy maturing and discretionary spending under pressure, future growth hinges on optimizing monetization rather than expanding user bases. Live streaming now serves as a bridge to direct purchasing, while short video channels increasingly focus on integrated advertising and e-commerce features.

Segment 2: Online Marketing & E-Commerce

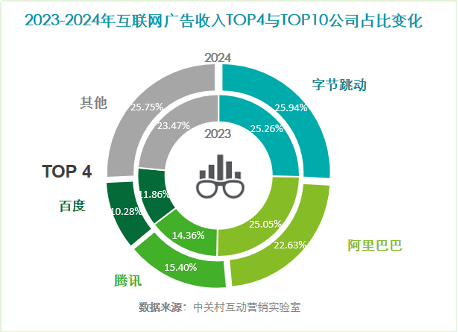

China’s online marketing services expanded at a CAGR of 8.3% between 2019-2024 and was valued at RMB651B, yet the market was highly concentrated. Alibaba, Tencent, Baidu, and Douyin together accounted for 74.25% of spending in 2024, with the top 10 platforms covering over 96%. Kuaishou ranked fifth by ad revenue that year. Source: https://finance.sina.com.cn/roll/2025-01-07/doc-ineeeanr1946962.shtml

Video content channel as a % of online marketing increases over time. Between 2020 and 2024, brands shifted ad budgets from search- and news-oriented formats to video advertising, mirroring user time spent on short-form clips and livestreams.

Online E-commerce sales of physical goods expanded 9% between 2019-2024 and was valued at RMB 1.3 trillion. The market is also highly concentrated with top 4 players accounting for 90% of the market. Change in market share overtime suggests PDD, Douyin and Kuaishou are taking market share from Taobao & Tmall and JD. Source: https://finance.sina.com.cn/tech/roll/2025-03-25/doc-ineqvray0067601.shtml

Emerging video platforms managed to gain market share while avoiding direct competition with traditional e-commerce players by introducing content led e-commerce rather than search-based e-commerce. This attracts SMEs due to lower entry barriers and the ability to reach mass markets with engaging content. Among consumers who purchased via short-form video, 57.8% made unplanned buys, driven by algorithmic product matching, immersive demonstrations, and impulse purchases during live sessions.

“Interest-ecommerce” model enables platforms like Douyin and Kuaishou to capture share from pure-play e-commerce sites by seamlessly embedding shopping into the content feed. Majority of the merchants of Douyin and Kuaishou are SMEs.

Value Proposition

Ecosystem

Kuaishou’s platform flywheel hinges on user scale and engagement time to power its three revenue streams—live streaming, online marketing, and e-commerce. Short videos attract and retain users, fueling live-streaming monetization, which drives content creation and user growth, unlocking advertising opportunities and, ultimately, e-commerce conversions.

To Users

Kuaishou offers authentic, grassroots content. Its decentralized algorithms ensure that every creator, regardless of follower count, can reach new viewers, driving a steadily increasing DAU/MAU ratio over time.

Complementing rather than directly competing with mass-focused platforms like Douyin. Kuaishou provides a unique content experience rooted in everyday life—farm-to-table cooking, local craftsmanship, rural culture—keeping users on the app longer and more frequently.

To Content Creators

Kuaishou’s live-streaming ecosystem empowers small-scale and emerging creators to share their passions while connecting them with merchants.

Viewers purchase in-app coins and gift virtual items during live shows, signaling support and unlocking perks for streamers.

Kling AI significantly lowers the barrier of entry and breakeven point for content production. Lower production costs enable a broader range of individuals to monetize content, expanding the creator base and deepening viewer engagement.

To Merchants

Kuaishou reduces competitive pressure for smaller merchants from competing against more established merchants through interest-ecommerce, where algorithmic matching, immersive video demonstrations, and impulse purchase dynamics drive sales rather than pure price discovery.

Reaching consumers who may not actively seeking to buy. Kuaishou’s lower-conversion environment nonetheless reaches consumers who may not be actively seeking to buy, resembling conditional reach.

Among purchasers influenced by short-form video, 57.8% had not planned a purchase beforehand, leveraging impulse buys driven by video content.

Kuaishou platform tailored for small and medium sized merchants and allow them to compete with larger merchants. SMEs benefit from Kuaishou’s self-serve ad platform, which features low minimum spends and dynamic audience-segmentation tools, allowing SMEs—which comprise majority of Kuaishou’s merchant base—to execute targeted campaigns alongside larger omnichannel strategies.

Business Moats Analysis

This virtuous cycle effect. Authentic social content → high engagement & trust → strong advertising and e-commerce performance → reinvestment into algorithms and community support—reinforces Kuaishou’s unique leadership to deliver differentiated value for users, creators, and merchants alike.

By avoiding head-to-head price competition with large incumbents and focusing on seamless content-to-commerce integration, Kuaishou has built durable cost and relevance advantages for small and mid-sized merchants, reinforcing its leadership in lower-tier markets.

Platform – Unique value proposition that works best for long tailed merchants for content creators.

Decentralized algorithmic moat that Douyin cannot duplicate. Kuaishou’s followers-first recommendation system ensures that small and mid-tier streamers gain predictable exposure and can monetize through live-stream gifting. This decentralized approach contrasts with Douyin’s viral-first algorithm, which prioritizes mass reach, and makes direct replication by competitors infeasible without sacrificing their core strengths. It also cements Kuaishou’s positioning as a complement to urban-focused platforms, akin to personalized streaming versus broadcast TV.

Content lead search offers unique value proposition to buyers and merchants relative to traditional platforms.

Scale-Driven Network Effects. With 409 million DAUs averaging 132.2 minutes per day on the platform, Kuaishou continuously enriches its content library and user-behavior datasets. This virtuous cycle attracts more creators—who seek engaged, grassroots audiences—and more advertisers. The result is a self-reinforcing creator-viewer loop that raises the cost and complexity of entry for new competitors

Habit Formation and High Switching Costs. Users spend roughly two hours per day on Kuaishou, building deep engagement habits around daily routines and local communities.

Creators and viewers both face high switching costs: streamers would lose their follower base and revenue streams, while viewers would forfeit established communities centered on authentic, regional content. These entrenched patterns make it unlikely that a new platform could dislodge Kuaishou without a truly disruptive innovation

Scale and Economics of Maturity. The live-streaming market now requires prohibitive R&D and infrastructure investment—estimated at RMB 3 billion upfront—to match Kuaishou’s functionality and reliability. To justify that investment at a 15% ROE, a new entrant would need 3.75 million paying users generating RMB 450 million in annual revenue and would incur RMB 112 million in customer acquisition costs alone. In contrast, Kuaishou can simply match any promotional spending and leverage existing cash flows to outlast smaller challengers.

Continuous Innovation as a Moving Target. Kuaishou’s ongoing rollout of AI-driven content tools (e.g., Kling AI) and other platform enhancements continuously raises the bar for features and user experience. Late-stage entrants face a moving-target challenge: they must invest heavily in development and marketing to catch up, with no guarantee of replicating Kuaishou’s entrenched ecosystem and network effects.

Reality Check – Market share + Return metrics Expansion

E-Commerce and advertising synergies. Kuaishou’s content lead provides a gateway into the highly concentrated online marketing and e-commerce markets.

Advertising market share grew from 4.4% in 2020 to 11% in 2024, demonstrating its rising importance to brands targeting grassroots consumers.

E-commerce GMV share expanded from 2% in 2020 to 5.9% in 2024, reflecting the platform’s success in converting engaged viewers into buyers through interest-ecommerce.

Operating leverage is evident.

Steady margin expansion from -19% in 2020 to 15% in 2Q25.

Steady expansion in adjusted assets above cost from -56% in 2020 to 1H25 40% annualized.

Growth Drivers

AI-powered content production. Advancements such as Kling AI will lower barriers to short-form video creation, driving both absolute and relative increases in time spent on these platforms. As AI tools streamline editing and production, a broader and more diverse creator base will emerge. Kuaishou’s decentralized recommendation algorithm will leverage this influx of new content, further boosting user engagement and session duration.

Online Marketing

Expansion in overall online marketing. The overall online marketing market is expected to grow at a compound annual growth rate of 8% from 2024 through 2030.

Within the expanding online market, video advertising—alongside e-commerce and social platform ads—is projected to increase its share of total online ad spend from 72% in 2024 to 80% by 2030. Kuaishou to maintain a roughly 15% share of this segment.

E-commerce

Growth will be primarily driven by payer conversion and nominal income increases in China.

Conversion rate (Paying users / MAUs) optimization offers significant upside potential. Baseline calculation projects a 25% conversion rate, up from 2024 levels of 19%. By combining the baseline conversion calculation projects 18% baseline conversion × (58%/35% engagement ratio) × 1.65 platform multiplier × 1.15 social trust uplift × 1.15 additional engagement factor = 25% projected conversion rate. This enhanced conversion aligns with Kuaishou’s community-driven commerce strengths.

Rising incomes support higher spending. Assuming an average monthly income of RMB 3,500 and a 30% savings rate, disposable consumption totals ~RMB 2,450 per user. Current e-commerce spending on Kuaishou of RMB 860 represents 35.1% of disposable consumption, suggesting existing users may be nearing peak penetration in line with historical trends.

Live Streaming

I expect live-streaming revenue to remain largely unchanged over the long term, reflecting mature market dynamics and intense competition.

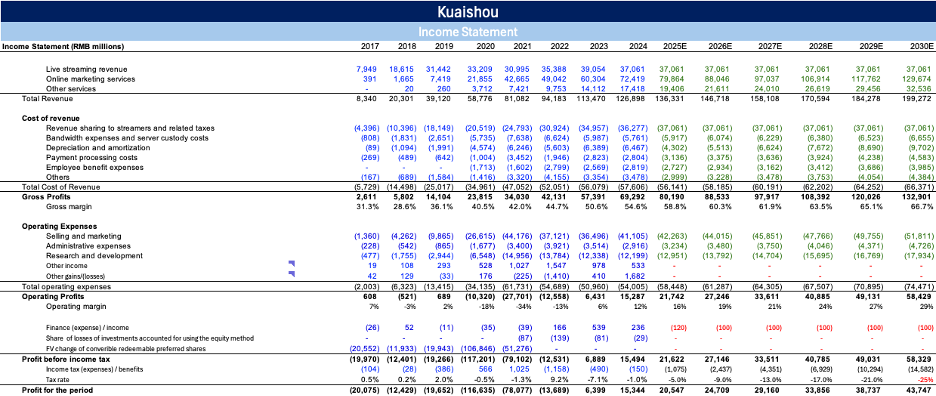

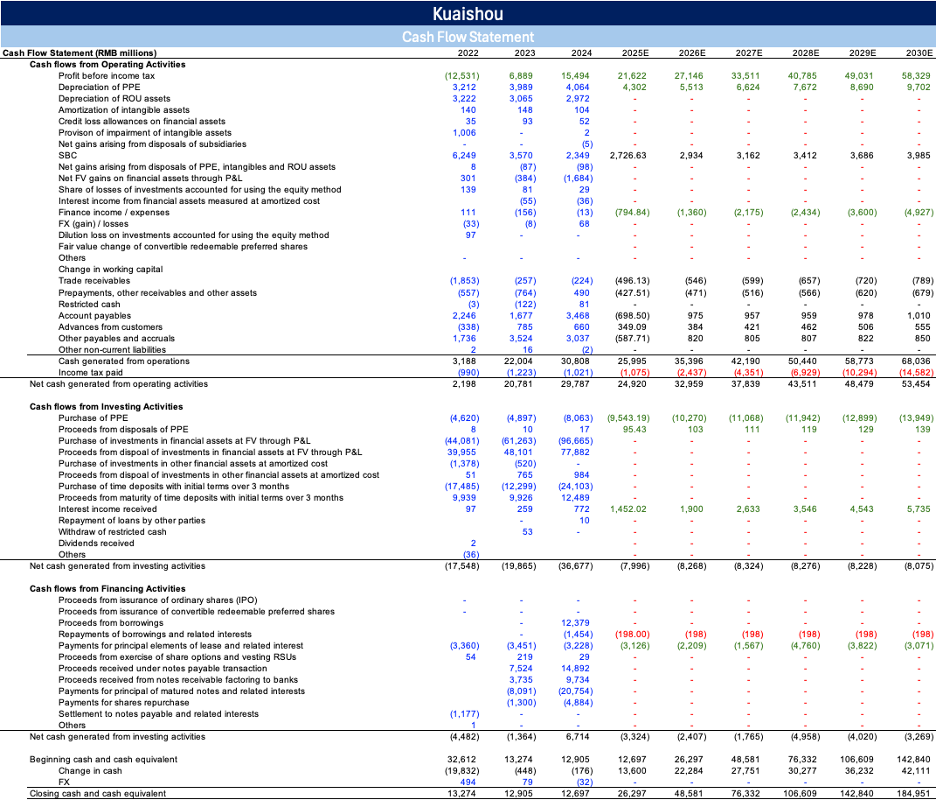

Key Financials and Forecast

Revenue is projected to grow at an 8% compound annual growth rate from RMB 136 billion in 2025E to RMB 199 billion by 2030E. This expansion reflects continued traction across Kuaishou’s core segments—particularly e-commerce and online marketing.

Gross margin is expected to widen from 58.8% in 2025E to 66.7% by 2030E. This improvement is driven by the scalable, high-margin nature of online marketing services, where incremental ad spend translates directly into elevated profitability.

Net profit is forecast to increase from RMB 21 billion in 2025E to RMB 44 billion by 2030E, representing a 16% CAGR. This acceleration is underpinned by Kuaishou’s operating leverage. As revenue scales, incremental profit will capture a rising share of top-line growth, translating into outsized net-income expansion.

The balance sheet remains conservatively positioned, with a gearing ratio of just 17.2% as of 2Q25.

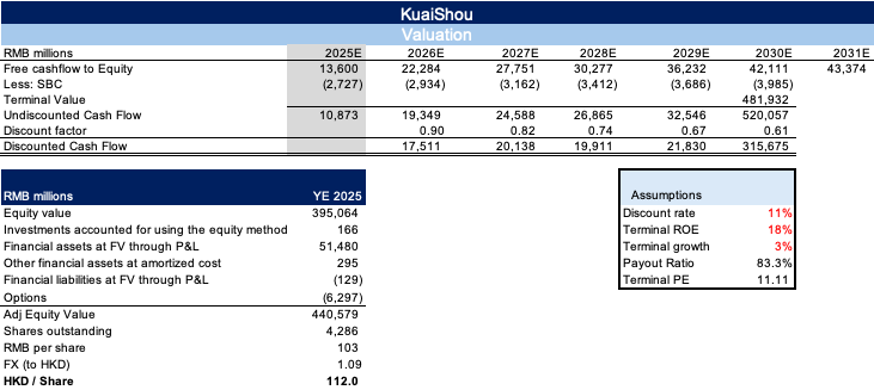

Valuation

Intrinsic value of $112 per share by YE25, representing 44% upside from current levels of $78 and reflecting the bullish thesis on the future of short video industry and the company's operational execution and market positioning.

Bear Case: If online marketing expands by just 4%—only half the rate assumed in our base-case model—Kuaishou’s intrinsic value would decline to approximately $89.

Key Investment Risks

E-commerce regulatory scrutiny & Content Compliance and Platform Governance.