Executive Summary

Gaia is not a streaming play but effectively a speculative biotech investment underpinned by Igniton’s unproven technology. With limited visibility into Igniton’s long-term prospects and no premium reflected in the share price above liquidation value, upside potential appears constrained while significant downside risk remains. Given this asymmetric profile—and lacking deep expertise in advanced biotech—this is not a stock I would initiate at current levels.

Business model. Gaia operates a subscription-based streaming service offering over 10,000 exclusive conscious-media titles complemented by a premium community platform and marketplace revenue.

Growth strategy. The company reinvests 15–20% of revenue into niche content, accelerates AI-driven personalization and community features with additional funding, and expands non-subscription offerings through Igniton supplements and potential licensing.

Narrow business moats. Continuous content investment and Igniton’s proprietary technology form potential moats, but untested pricing power, low switching costs, and scale disadvantages challenge durability.

Weak return profile. Gaia generates minimal free cash flow (under 1% of enterprise value) and lacks operating profitability.

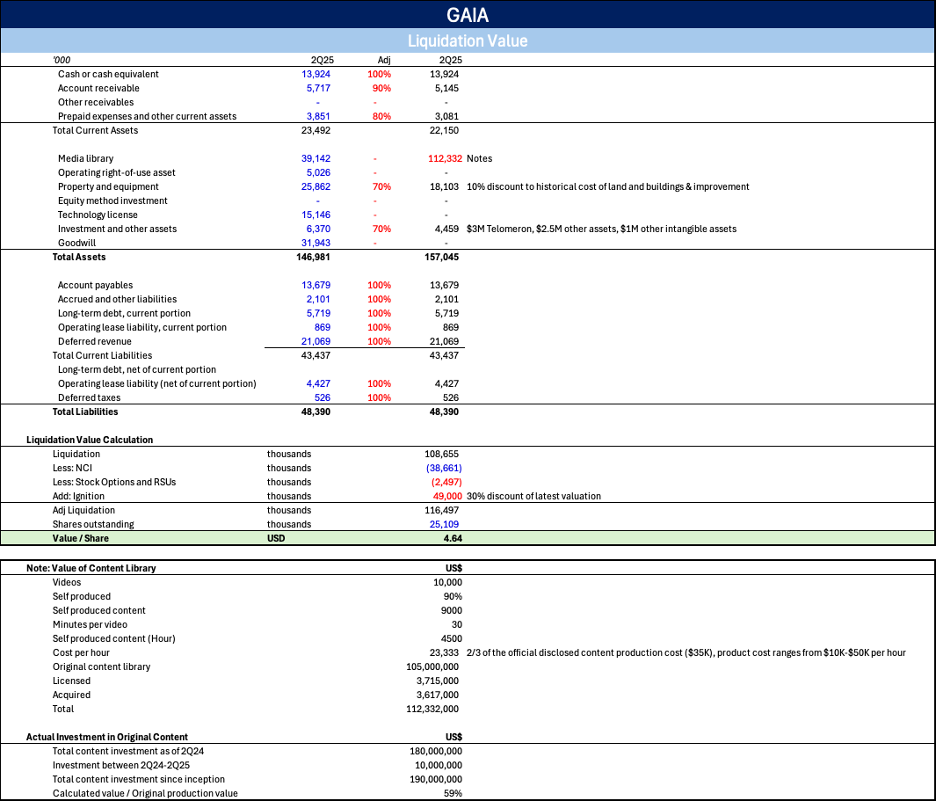

A liquidation framework yields a $4.6 per-share value—anchored by a $112 million content library and $49 million Igniton stake—highlighting constrained upside beyond liquidation value.

Business Model

Gaia is a subscription-based, global streaming platform dedicated to conscious media, offering over 10,000 video titles spanning yoga, meditation, personal transformation, alternative history, and wellness. Its mission is to cultivate a community focused on spiritual growth and mindful living. Its strategy centers on two pillars.

Niche, purpose-driven programming. Gaia curates deeply specialized content—ranging from consciousness-expanding documentaries to transformational workshops—that appeals to an audience underserved by mainstream platforms. Approximately 90% of its library is exclusive, in-house production, and this proprietary content accounts for roughly 75% of total member viewing tim

Community engagement via Gaia+ Premium. Launched in March 2024, the Gaia+ premium tier extends beyond on-demand videos to include live seminars, interactive Q&A sessions with thought leaders, and peer discussion forums. This premium layer strengthens member loyalty and deepens engagement by fostering real-time connections.

Gaia marketplace. Introduced in August 2024, the Marketplace offers retreats, live events, courses, workshops, and curated conscious-living products. (image source: gaia.com)

Revenue stream. Gaia revenue discloses its subscription revenue and non-subscription revenue in its 10K. Membership fee accounted for 98%, 97% and 96% of the total revenue in 2022, 2023, 2024 respectively.

Membership fee. Consists of the base subscription and premier subscription. Basic plan costs $13.99/month, or $119/yr. Premium plan costs $299/yr.

Non-membership fee: Primarily marketplace and advertising revenue.

Core audience. Predominantly female (approximately 75%), well-educated, and with household incomes above $75,000.

Geographical reach. As of 2Q25, 60% of revenue originates in the United States, with most of the remainder from Canada and Australia based on billing locations.

Customer acquisitions. A broad mix of marketing and public relations programs, including social media websites such as Facebook and YouTube

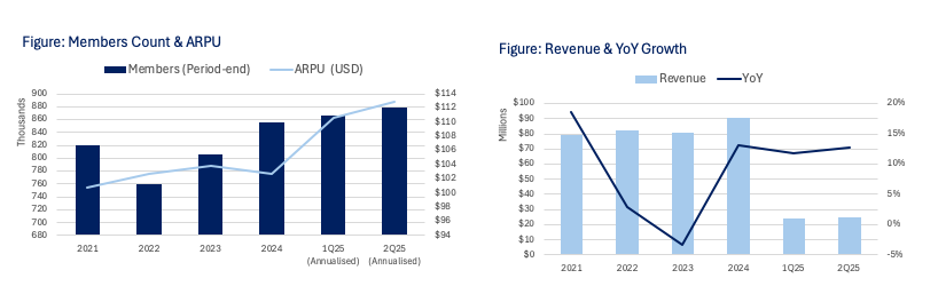

Member growth and increased revenue per user have driven historical expansion. From 2020 through 2Q25 (annualized), total revenue grew by 8%, evenly split between subscriber additions and higher average revenue per user (ARPU). Early indications suggest that the Marketplace launch, and recent price adjustments have had limited sustained impact on ARPU, underscoring the importance of ongoing content innovation and community features.

Source: Gaia.com

Growth Strategy

The company is pursuing a multi-pronged strategy across its streaming platform and Igniton subsidiary.

Streaming Platform

Investment in original content. Gaia will continue to reinvest 15–20% of revenue in exclusive content, ensuring a steady pipeline of niche programming that differentiates the service.

Artificial intelligence. Gaia accelerated initiatives in February 2025 by selling 1.6 million Class A shares at $5 per share to fund both AI and community platform development. The proprietary AI model—trained on Gaia’s unique dataset—will power advanced search, personalized recommendations, language translation, and dynamic content curation, deepening user engagement and loyalty.

Subscription pricing to optimize revenue. After raising the monthly base price by 17% to $13.99 in 4Q24 (initially driving a 6.3% churn that eased to 7.5% by March 2025), Gaia plans a further 14% hike to $15.99 per month for 80% of existing subscribers in March 2026, timed with AI feature rollouts and the launch of the Gaia Community digital member hub.

Content licensing. Management is also exploring content licensing partnerships, though as of 2Q25 no hyperscalers have engaged.

Igniton

Igniton. Gaia has a majority stake in Ignition (71% of Igniton as of 2Q25). Igniton’s proprietary quasi-particle technology—designed to enhance cognition, memory, and longevity via both ingestible supplements and future embedded delivery systems—received backing through private financing rounds that lifted its valuation from $40 million in 2024 to $106 million in 2025.

Short-term revenue drivers include the recent launch of two supplements—Igni Cognition and Igni Longevity—priced at $169 per month for members ($199 for non-members). Gaia forecasts over $1.1 million in Igniton-derived revenue in 2025, strengthening non-subscription revenue diversification.

Technology Licensing remains highly speculative but potentially lucrative growth vector, pending clearer management plans and external validation of efficacy.

Source: Gaia.com

Industry Analysis

Subscription Video on Demand (SVOD) business strategies represent a fundamental departure from traditional television and film distribution models. Linear networks rely on mass-audience aggregation—curating limited premieres and scheduling to capture simultaneous viewership—whereas SVOD services grant on-demand access to vast libraries, enabling personalized consumption and long-tail engagement.

SVOD business models vary widely, creating distinct niches.

Global incumbents (e.g., Netflix) leverage scale to produce and license mass-appeal originals, spreading costs across hundreds of millions of subscribers. Their growth has historically been driven almost exclusively by paid membership expansion. Recent moves into ad-supported tiers have further lowered ARPU despite headline price increases, as customers trade higher cost for lower-priced, advertising-backed options.

Specialized platforms (e.g., Gaia, CuriosityStream) target passionate sub-segments—wellness, spirituality, science, history—where tailored content drives deeper engagement among smaller audiences.

Despite premium tiers and marketplace revenue, Gaia’s ARPU still trails Netflix’s, reflecting both Netflix’s scale advantages and Gaia’s ongoing need to demonstrate operating leverage from its investments. Mainstream services rarely enter deeply niche verticals due to lower marginal returns; Netflix’s U.S. library contains fewer than 50 wellness and spirituality titles—just 0.5% of its catalog—underscoring the opportunity for specialist players.

Between 2022 and 2024, Netflix’s global subscriber base rose sharply, while its ARPU growth remained muted as ad-supported offerings cannibalized higher-priced tiers. In contrast, Gaia’s expansion reflects a balanced mix of subscriber growth and ARPU increases, supported by premium pricing, the Gaia+ community hub, and a nascent marketplace.

Churn trends across major U.S. platforms increased in 1Q25 versus 1Q24, driven by competitive pricing and content cycles. Younger demographics (ages 25–34) maintain the highest subscription rates but also exhibit more rapid churn, highlighting the importance of constantly refreshed, deeply relevant content for retention. (Image source: https://variety.com/2025/tv/news/content-spending-2024-record-210-billion-comcast-youtube-disney-1236526081/)

Business Moats

Streaming Platform

Gaia’s primary moat derives from its exclusive content library and continuous reinvestment is required to maintain this advantage and prevent content commoditization. The company plans to invest 15%-20% of its revenue in content addition.

Unproven pricing power. Gaia’s recent price hikes have yet to fully validate its ability to command higher subscription fees. In 2Q25, ARPU fell 4% relative to 4Q24 despite only half of the $13.99 base-price rollout, implying that promotional campaigns are masking true churn impacts. A further price increase scheduled for March 2026 will put Gaia’s pricing resilience to a more definitive test.

Low community moat. The Gaia+ premium community—featuring live seminars and peer discussions with thought leaders—enhances stickiness but does not constitute a unique moat, since featured speakers also publish on other platforms. True differentiation will depend on Gaia’s ability to secure exclusive partnerships or create proprietary community experiences that cannot be easily replicated.

Low switching costs. Unlike larger SVOD players that embed viewing histories into AI-driven recommendations, Gaia’s limited scale means members can cancel with minimal friction. The absence of a deeply personalized algorithmic lock-in makes subscriber churn more sensitive to content cycles and price adjustments.

Scale disadvantage. Mainstream platforms could replicate Gaia’s niche offerings at a lower marginal cost. For example, reallocating just 1% of Netflix’s 2024 content budget (~$162 million) toward conscious-media titles would outpace Gaia’s entire annual content spend by 18×, eroding Gaia’s cost-based moat.

Content Licensing

Content library lacks the depth and research rigor of platforms like CuriosityStream, reducing its appeal as a training corpus for AI-driven licensees. Minimal engagement from hyperscalers underscores the limited external value of Gaia’s licensed assets.

Igniton

Technology moat. Unique delivery mechanism could form a technology moat if independent, peer-reviewed studies validate its benefits.

Premium priced but lack of independent science backed research. Despite commanding premium price points ($169–$199 per bottle), Igniton’s supplements use ingredients common to existing products (costs $30-$80). The lack of third-party scientific validation heightens the risk of consumer skepticism.

DNP’s use as a weight-loss agent in the 1930s, illustrate the narrow therapeutic window and potential toxicity of unproven treatments. Without robust safety and efficacy data, Igniton’s technology could face similar setbacks, eroding any nascent competitive advantage.

Management & Execution risks. Operating a biotech-style subsidiary requires specialized skills in clinical validation, regulatory affairs, and distribution—areas outside Gaia’s core streaming expertise. The absence of proven management capabilities in these domains represents a material execution moat risk.

Value Proposition

Streaming Platform (Alternative Content SVOD)

Gaia’s alternative-content SVOD differentiates itself through a dual focus on exclusive programming and community-driven experiences.

Content strengths. Gaia’s curated catalogue of niche titles—spanning consciousness, personal growth, and esoteric history—serves as a complement to mass-market streaming services. While yoga and meditation offerings face competition from free and freemium apps, Gaia’s proprietary documentaries and original series deliver the highest perceived value.

Experience differentiation. Rather than invest in proprietary global delivery infrastructure like Netflix, Gaia enhances the user journey through the Gaia+ premium community, which provides live seminars, interactive Q&A sessions, and peer discussion forums. This communal layer creates a friction-free ecosystem where members connect around shared interests—an offering that mass-market SVODs lack. Planned rollouts of AI-driven personalization, advanced search, and intelligent member support promise to deepen engagement further, although user-level data remains limited at this stage.

Customer stickiness. A 6.3% churn rate following a 20% price increase—after more than four years of stable pricing—could suggest exceptional loyalty and validates the value proposition.

Licensees

Content licensing. Primarily saves cost through gathering in depth information itself.

Igniton technology licensing. If Igniton’s proprietary quasi-particle platform proves to be effective, there is potential for licensing agreements in both supplement manufacturing and embedded-delivery systems—unlocking a novel revenue stream beyond subscriptions.

Supplments

Formulated to support cognitive function and promote healthy aging.

Key Financials

An examination of Gaia’s historical financials underscores the challenges to sustaining its moats.

Low cash flow generation. Over the past three years, Gaia’s free cash flow to firm (operating + investing cash flows, excluding acquisitions) has remained minimal: +$1.9 million in 2024, $0.6 million in 2023, and –$6.7 million in 2022. With an enterprise value of $142 million, free cash flow represents just ~1% of firm value.

Negative return on asset. Gaia has yet to generate a positive operating profit before tax, resulting in negative returns on assets and signaling that current operations do not cover the cost of capital.

Low financial leverage. As of 2Q25, it has $5.7m debt (mortgage loan), represents just 4% of the firm’s total assets.

Low operating leverage. Cost of goods sold has held near 14% of revenue, while selling and operating expenses have consistently exceeded 80% of revenue since 2023.

Valuation

Given Gaia’s limited ability to generate sustainable returns from its streaming operations, a liquidation valuation provides the most realistic estimate of intrinsic value.

Liquidation value of $4.6 per share.

Stake in Igniton valued at $49M, 70% discount to Igniton’s $106 million post-money valuation.

Content library valued at $112M, a 38% discount to the $180M spent on original series and documentary development.

This framework underscores that Gaia is not a high-growth streaming play but effectively a speculative biotech investment underpinned by Igniton’s unproven technology. With limited visibility into Igniton’s long-term prospects and no premium reflected in the share price above liquidation value, upside potential appears constrained while significant downside risk remains. Given this asymmetric profile—and lacking deep expertise in advanced biotech—this is not a stock I would initiate at current levels.

Key Investment Risks

Ownership concentration. As of 4Q24, founder and chairman Jirka Rasavy controls 75% of voting rights, raising governance risk and potential minority-shareholder conflicts.

Management expertise mismatch. Gaia’s leadership excels in streaming operations but lacks proven experience in early-stage biotech and supplement commercialization, heightening execution risk for Igniton

Valuation volatility. Slightly half of Gaia’s implied equity value resides in its 71% stake in Igniton, an unproven tech venture. Igniton’s early-stage status and absence of independent efficacy data could lead to significant swings in liquidation valuation.

Consumer discretionary pullback. Gaia’s premium pricing positions it as a discretionary expense. Economic downturns or consumer pullback in wellness and lifestyle spending could compress subscription growth and renewals.