Executive Summary

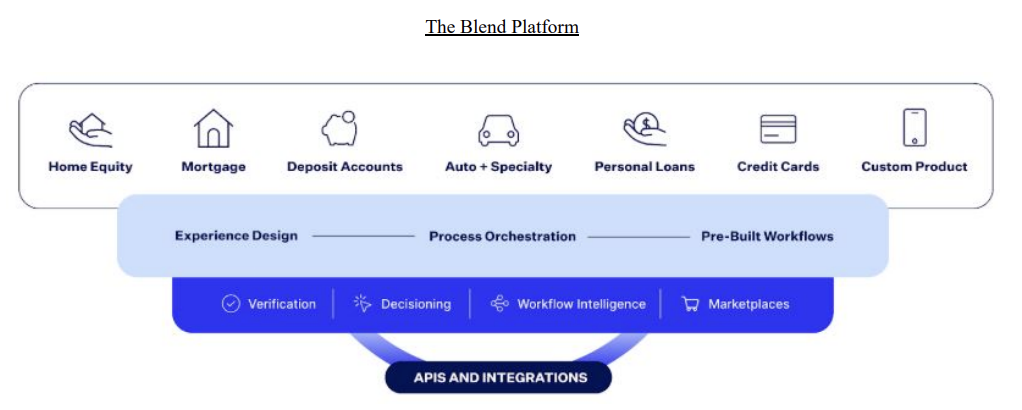

Blend Labs provides a cloud-native, white-label software platform that modernizes loan origination for financial institutions. Functioning as an agile overlay atop legacy Loan Origination Systems (LOS), Blend offers a low code "storefront" that unifies the customer journey across mortgages, consumer banking (auto, personal, credit cards), and deposit accounts. By integrating third-party "best-in-class" services—such as credit bureaus, fraud checks, and pricing engines—into a seamless workflow, Blend automates manual tasks to reduce friction and origination costs.

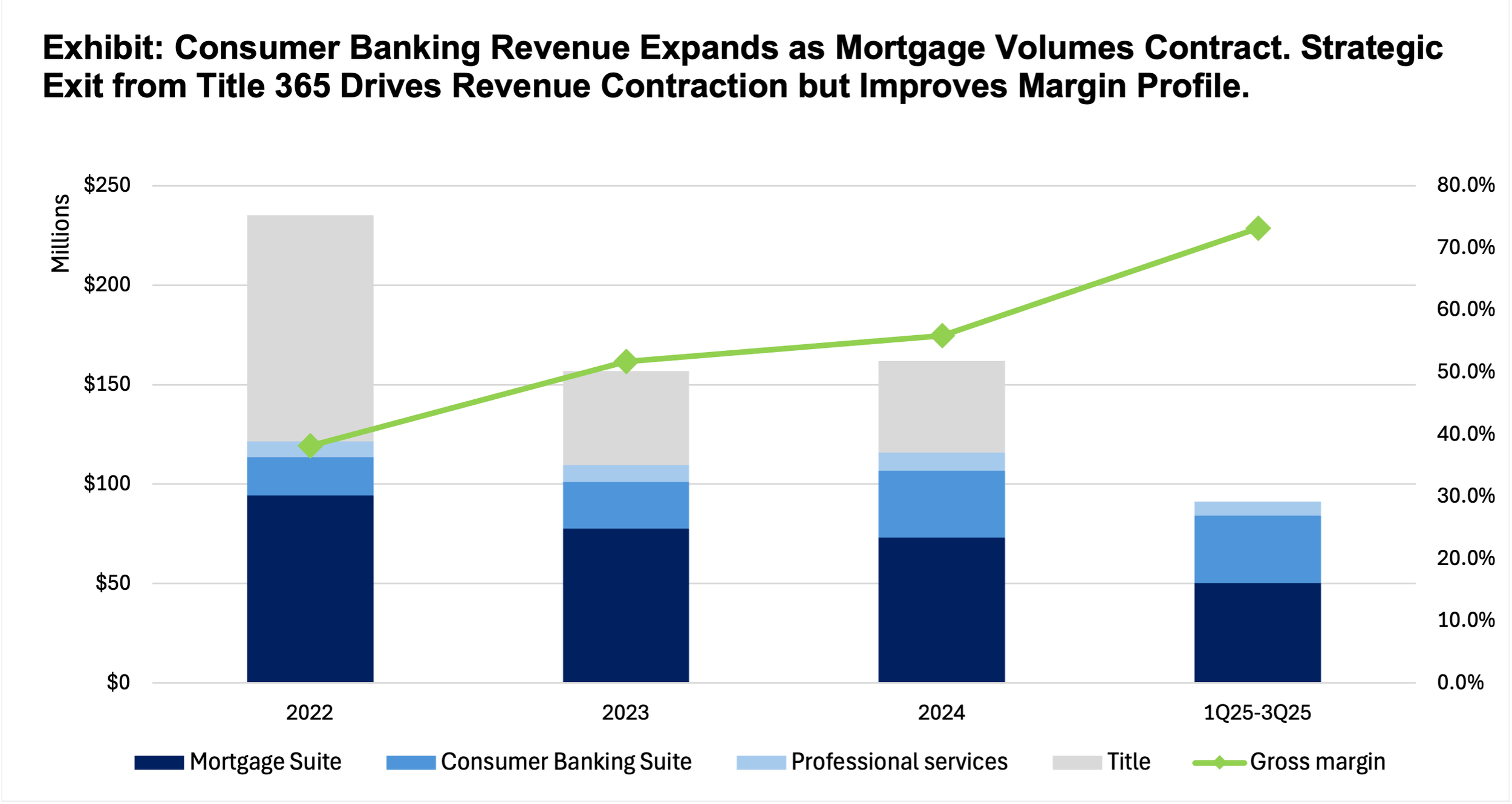

Blend lab generates revenue through (1) mortgage suite, (2) consumer banking suite, and (3) professional service. As of 3Q25,

Mortgage suite (54% of revenue, -17% YoY). Provides end-to-end solutions from pre-application to close. Revenue is predominantly transaction-based, creating high sensitivity to US housing market volumes and interest rate cycles

Consumer banking suite (39% of revenue, +34% YoY). The primary diversification engine designed to reduce reliance on mortgage volatility. Recent growth is attributable to (1) platform pricing increases, (2) volume growth in deposit account openings, and (3) Home Equity (HELOC) products

Professional service (7% of revenue, +18% YoY). Implementation and advisory fees

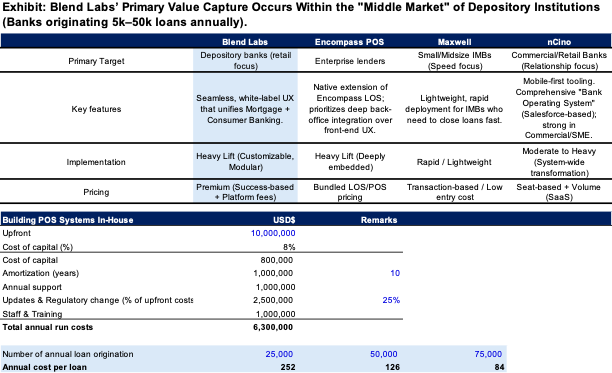

Blend Labs’ primary value capture occurs within the "Middle Market" of depository institutions (banks originating 5k–50k loans annually). These institutions are too large to rely on manual processes but too small to justify the massive capex of building proprietary tech stacks like Rocket Mortgage or UWM. Blend provides an "off-the-shelf" modernization layer that allows these regional banks to compete on user experience (UX) without incurring technical debt.

Market share contraction from 23% to 17% alongside negative operating margins strongly suggests that Blend Labs possesses no durable competitive moat due to low pricing power and low switching cost. The platform exhibits characteristics of a commoditized "feature" rather than a mission-critical system of record.

Stabilized Earnings Power appears to be the most appropriate valuation method. While mortgage suite could rebound strongly as rates are lower, its consumer banking will likely suffer from HELOC reversal and lowered deposit account velocity.

Initiate Sell with $1,4 Target Price, represents 53% decline from the current $3 market price. With the stock trading significantly above this level, I see >50% downside risk as the market reprices the "growth" narrative to a "value trap" reality.

Business Model

Blend Labs provides a cloud-native, white-label software platform that modernizes loan origination for financial institutions. Functioning as an agile overlay atop legacy Loan Origination Systems (LOS), Blend offers a low code "storefront" that unifies the customer journey across mortgages, consumer banking (auto, personal, credit cards), and deposit accounts. By integrating third-party "best-in-class" services—such as credit bureaus, fraud checks, and pricing engines—into a seamless workflow, Blend automates manual tasks to reduce friction and origination costs.

Blend utilizes a "land and expand" strategy, typically entering just one product before cross-selling broader banking products. As of 3Q25,

Mortgage suite (54% of revenue, -17% YoY). Provides end-to-end solutions from pre-application to close. Revenue is predominantly transaction-based, creating high sensitivity to US housing market volumes and interest rate cycles

Consumer banking suite (39% of revenue, +34% YoY). The primary diversification engine designed to reduce reliance on mortgage volatility. Recent growth is attributable to (1) platform pricing increases, (2) volume growth in deposit account openings, and (3) Home Equity (HELOC) products

Professional service (7% of revenue, +18% YoY). Implementation and advisory fees

Management is actively trading lower-margin intermediary revenue for higher-margin, capital-light software fees. By partnering with specialist providers rather than maintaining proprietary data bureaus, Blend operates as a software hub for add-on services. This transition reduces top-line revenue growth but structurally improves gross margins.

Management’s capital allocation track record is marred by significant value destruction, most notably through the ill-timed acquisition of Title 365. Purchased near peak-cycle volumes in 2021, the asset exemplified a "growth-at-all-costs" strategy that failed to account for cyclical risks. The financial deterioration has been stark: Title 365 swung from generating $36M in Net Income (FY2020) to a $5.7M loss in the first three quarters of 2025. Following the decision to divest the asset at a loss in June 2026, management has guided for a corresponding 1% contraction in loan origination market share for FY2026

Significant customers’ concentration risk. While market share has contracted by ~4%, revenue concentration among >$1M ARR customers has risen from 53% to 63%. This divergence suggests smaller, cost-sensitive lenders are churning off the platform, leaving Blend increasingly reliant on a smaller cohort of large enterprise clients.

Industry Analysis

Segment - Mortgage Suite

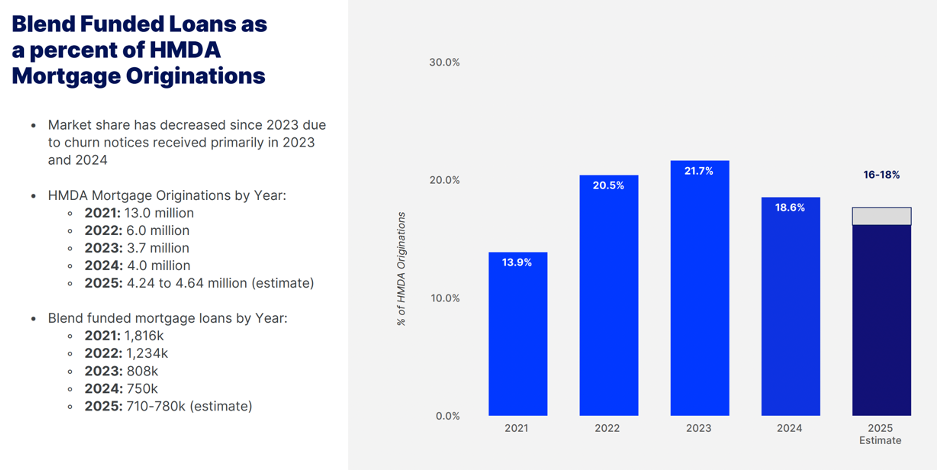

Mortgage origination volumes are inherently volatile and highly sensitive to interest rate cycles. Industry volumes collapsed from a peak of ~13 million originations in 2021 to an estimated 4.5 million in 2025E (>70% decline). Source: Blend Lab

Competitive segmentation: The POS landscape is bifurcated by lender type.

Blend Labs: Dominates the Depository Bank segment (e.g., U.S. Bank, Wells Fargo).

nCino: Stronghold among Independent Mortgage Banks (IMBs) (e.g., CrossCountry, Fairway).

Proprietary Tech: The largest IMBs (Rocket Mortgage, UWM) continue to invest in in-house solutions to maintain vertical integration.

Structural shift to non-banks. Regulatory arbitrage and speed advantages have allowed non-bank mortgage companies to aggressively capture market share from traditional banks. Non-banks now control 69.8% of the top 50 purchase loan market (up from 62.1% in 2020), while banks have retreated to 29.5%. This structural shift creates a headwind for Blend, whose customer base is heavily skewed toward.

Consistent with this shift, Blend’s market share has contracted from 23% (2022) to an estimated 17% (2025E). This erosion is driven by two factors:

Insolvency & Cost Cutting: Smaller lender clients are exiting the business or migrating to "good enough," lower-cost/free alternatives to survive razor-thin margins.

Strategic Exits: Major clients like Wells Fargo have exited correspondent lending entirely to focus on narrower retail footprints.

2026 Outlook: Management has guided for an additional ~100 basis points of churn headwinds in 2026.banks

Segment - Consumer Banking Suite

The "Consumer Banking" hedge faces a distinct counter-cyclical risk.

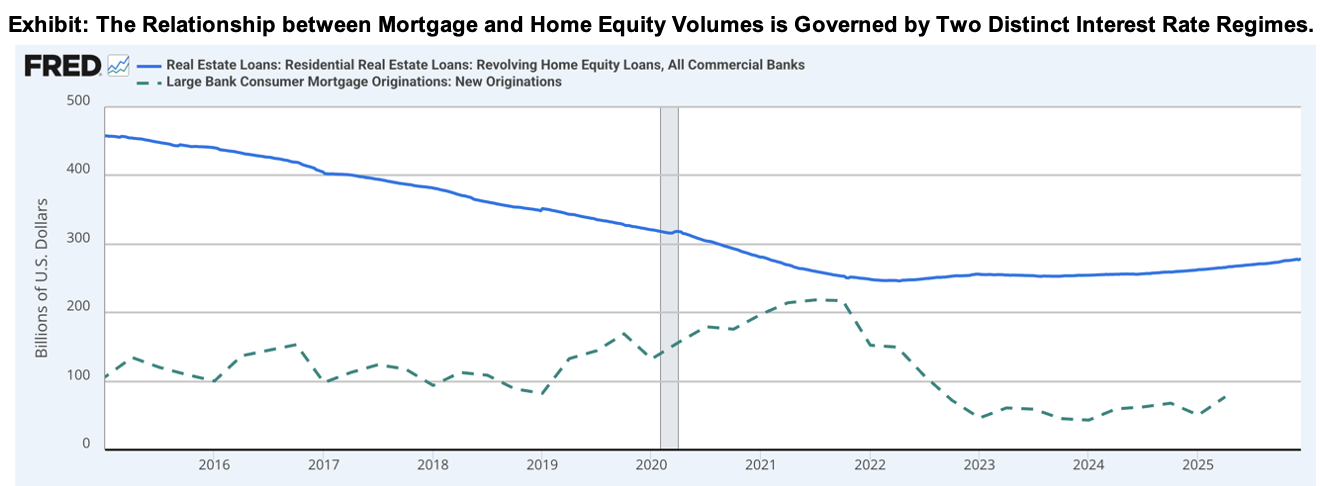

The relationship between Mortgage and Home Equity (HELOC) volumes is governed by two distinct interest rate regimes. As rates normalize downward, we expect a reversion to Regime 1, where HELOC volumes may cannibalize back into primary mortgage refinances, potentially stalling this growth engine.

Low rate environment: Cash-Out Refinance Dominance: With mortgage rates at historic lows (2.5%–3%), borrowers consolidated debt via cash-out refinances. It was economically irrational to hold a separate, higher-rate HELOC. Consequently, debt volume shifted from the HELOCs to Mortgage Originations, suppressing demand for Blend’s standalone consumer equity products.

High rate lock-in 2022-2025 - As primary mortgage rates spiked, refinancing became unattractive for borrowers locked into low rates. However, homeowners retaining record equity levels turned to HELOCs for liquidity. Despite high rates (9%+), a small HELOC was mathematically superior to refinancing the entire capital structure of the home. This regime temporarily boosted Blend's consumer suite volumes.

Deposit account velocity is highly correlated with rate volatility and the "rate shopping" phenomenon.

Rising Rate Cycle: As Fed rates rose, the spread between bank offers widened, incentivizing consumers to churn accounts in search of yield. This velocity directly benefits Blend’s transaction-based fee model.

Falling/Stable Rate Cycle: Since banks typically lag Fed cuts, existing yields remain "sticky," which incentives consumer to continue to move funds to banks. I anticipate a material deceleration in new account openings as volatility subsides and rates normalize.

Value Propositions

Blend Labs’ primary value capture occurs within the "Middle Market" of depository institutions (banks originating 5k–50k loans annually). These institutions are too large to rely on manual processes but too small to justify the massive capex of building proprietary tech stacks like Rocket Mortgage or UWM. Blend provides an "off-the-shelf" modernization layer that allows these regional banks to compete on user experience (UX) without incurring technical debt.

Blend's pitch is not just "better software," but measurable operational leverage. According to a validated study by MarketWise Advisors, the platform delivers:

Cost Savings: Approximately $824 – $962 per loan in net operational savings.

Cycle Time: Compresses "application-to-close" times by ~7.3 days (vs. industry standard ~30-45 days), significantly reducing hedging costs.

Conversion: "One-tap" pre-approvals and omni-channel connectivity drive higher application pull-through rates.

The "Walled Garden" Strategy (Ecosystem Value) Blend is attempting to build a two-sided network effect between Lenders and Software Partners.

Vendor Consolidation: For lenders, Blend aggregates fragmented vendors (credit, title, verification) into a single contract. This increases Blend's and its partners’ bargaining power and creates a "vendor of record" moat. Instead of selling to thousands of banks individually, software vendors (like credit or fraud agencies) integrate with Blend once to reach the entire client base. This significantly lowers their sales and marketing costs.

Operational simplicity for banks: Smaller lenders often lack the IT resources to connect multiple separate software tools. By pre-integrating these third-party vendors into a single 'bundled' offering, Blend removes the technical burden from the banks. This prevents lenders from defecting to 'all-in-one' competitors who claim to offer a simpler, pre-built stack.

Business Moats

Market share contraction from 23% to 17% alongside historical negative operating margins strongly suggests that Blend Labs possesses no durable competitive moat. The platform exhibits characteristics of a commoditized "feature" rather than a mission-critical system of record.

Weak Switching Costs (The "Churn" Evidence) Blend is an "overlay" solution, not the underlying database (the LOS). This makes it significantly easier to rip and replace than a core system like Encompass or nCino. During the 2023–2024 downturn, lenders facing margin compression successfully migrated to lower-cost or "good enough" alternatives without catastrophic operational disruption. If the product were truly mission-critical, churn would have been resilient to the cycle. Instead, the customer base treated Blend as a discretionary expense.

Absence of Pricing Power. In Blend’s case, pricing is dictated by the customer’s P&L health. With revenue concentration among top clients rising (>$1M ARR cohort at 63%), large enterprise tenants hold disproportionate leverage. This lack of leverage was starkly illustrated during the recent renewal with Wells Fargo (a top-tier client), where Blend reportedly conceded to a discounted pricing structure to retain the volume. The inability to defend unit economics during a downturn confirms that the solution is viewed as a variable cost center to be optimized, rather than a strategic asset to be protected.

Company Outlook

Debate #1: Will rate cuts automatically trigger an origination boom?

View: Not necessarily. The relationship is non-linear.

The affordability trap: Lower rates alone are insufficient. For volume to return to the historical mean (7m units annually), rates must drop to the 5%–6% range + housing prices must moderate to restore affordability.

The "lock-in" hurdle: Borrowers currently "trapped" in 3% mortgages will not sell (and originate a new buy-side loan) until the spread between their current rate and the market rate narrows significantly. Until then, inventory remains frozen.

Debate #2: Can market share rebound via the middle market?

View: Unlikely.

TAM Reality Check: We estimate Blend’s true addressable market is capped at ~30% of US mortgage volume (excluding giants with proprietary tech ~20% and small lenders ~50% cannot afford it).

Structural Headwind: With banks continuing to cede share to non-banks, Blend is fighting for a larger slice of a shrinking pie. Given the direct competition from nCino in the mid-market, future share gains will be marginal at best.

Debate #2: Is growth in consumer suite sustainable?

View: The recent growth is likely transitory.

The HELOC reversal: As rates fall, the "Substitution Effect" reverses. Homeowners will stop originating separate, high-interest HELOCs (which drove Blend's recent growth) and return to consolidated cash-out refinances. This shifts volume back to the Mortgage segment but cannibalizes the high-growth consumer suite revenue.

Deposit account velocity: Deposit account openings are driven by volatility (rate shopping). As the Fed easing cycle stabilizes rates, the urgency for consumers to switch banks dissipates. The velocity of new account opening (the specific event Blend monetizes) is likely to decelerate from peak levels.

Valuation

Initiate Sell with $1.4 Target Price, represents 53% decline from the current $3 market price. With the stock trading significantly above this level, I see >50% downside risk as the market reprices the "growth" narrative to a "value trap" reality.

Methodology: Stabilized Earnings Power where mortgage volumes revert to historical averages. Even under these generous recovery assumptions, the intrinsic value implies significant downside.

Normalized Mortgage Volume: 7.0 million annual industry originations (reverting to historical mean).

Market Share: Held flat at 17% (assuming no further churn, despite current headwinds).

Unit Economics: Assumes Blend successfully expands its "Economic Value per Loan" to $100 (up from ~$86 today) and achieves a long-term gross margin of 80% via its platform-fee transition.

Fixed Costs: OpEx (R&D, S&M, G&A) held constant at annualized 3Q25 levels.

Under this scenario, Blend generates:

Stabilized Revenue: ~$179.5M ($119M Mortgage + $60.5M Consumer/Professional Services).

Stabilized Gross Profit: ~$143.6M (80% margin).

Stabilized Operating Profit (Proxy for FCFF): ~$26.5M.

Stabilized Equity Value per share is ~$1.4. Assumed a 6% yield (derived from 9% WACC less 3% terminal growth), the implied Stabilized Enterprise Value is ~$530M. Then adjusting for net cash, preferred equity (~$155M), and outstanding options.

While the theoretical stabilized value is ~$1.4, achieving this state requires a long time horizon (volume recovery, extracting value from existing customers, partnership expansion). Given the high uncertainty of this timeline (likely 3+ years), the risk-adjusted fair value sits below this stabilized ceiling. Suggested Long Entry of $1.0 (discounted by additional 3 years of 9% WACC) represents the firm's maximum stabilized earnings power.

Key Investment Risks

Significant customer concentration risk + Low pricing power.