Executive Summary

CuriosityStream is a subscription-based streaming platform specializing in premium factual documentaries and educational content. Founded in 2015 by Discovery Channel founder John Hendricks, the company operates a comprehensive library of over 3,000 titles, including more than 900 exclusive originals.

CuriosityStream is executing a fundamental strategic pivot from a direct-to-consumer subscription model toward content licensing as the primary revenue driver. The direct subscription business lacks the requisite content exclusivity, customer experience, and marketing muscle to fend off larger rivals, placing future revenue at risk. By contrast, the content-licensing arm enjoys high margins and low incremental cost, but its long-term scalability depends on still-nascent demand from a limited pool of AI customers.

CuriosityStream lacks sustainable competitive moats. The company operates in two fundamentally different business segments: a declining direct subscription service devoid of competitive advantages and a content licensing operation characterized by high operational uncertainty and episodic revenue patterns.

Suggested entry of $1.9, representing 30% discount to the liquidation value. Reflecting the lack of competitive moats and the view that the 7% dividend yield is unlikely to be sustainable long-term.

Company Overview

CuriosityStream is a subscription-based streaming platform specializing in premium factual documentaries and educational content. Founded in 2015 by Discovery Channel founder John Hendricks, the company operates a comprehensive library of over 3,000 titles, including more than 900 exclusive originals.

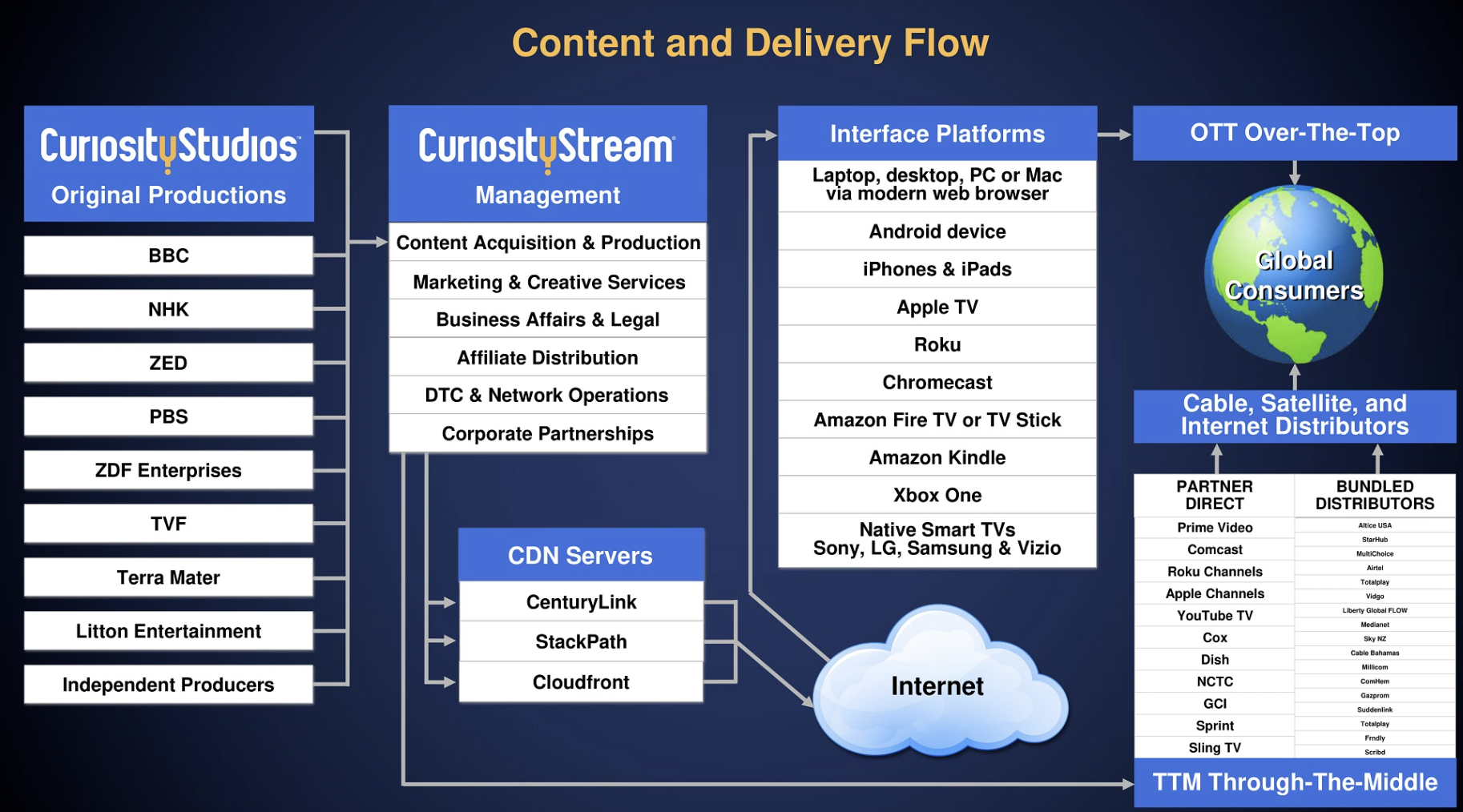

CuriosityStream operates through four distinct business segments that generate revenue across the streaming value chain.

(a) Direct business: Encompasses both direct-to-consumer subscriptions and partner direct channels.

(b) Content Licensing: Traditional licensing agreements plus emerging AI training data partnerships.

(c) Bundled distribution: Partnerships with cable, satellite, and streaming platform providers.

(d) Other revenue: Including advertising and ancillary services.

Revenue demonstrated strong historical growth with revenue expanding at a CAGR of 23% between 2019-2024. This growth trajectory was primarily driven by the expansion of its direct-to-consumer business and strategic partnerships.

However, the company faced challenges in its direct business starting in 2024. Its direct business dropped 9% YoY in 1Q25 due to a drop of subscribers.

The United States remains CuriosityStream's dominant market, accounting for approximately 65% of total revenue in 2024 and 71% in Q1 2025

CuriosityStream achieved positive operating cashflow since 1Q24 and declared $0.025 per share quarterly in 2Q24. The company has increased its dividend, reaching $0.08 per share in Q2 2025. The operating cashflow was achieved primarily through significantly cutting back in advertising and marketing, as well as acquisition of contents through cash.

Segment Breakdown

Direct Business

Recurring annual & monthly subscriptions to Curiosity services across multiple platforms. The majority of subscribers access content through CuriosityStream's proprietary platforms via direct-to-consumer (DTC) channels, while the remainder utilizes partner platforms including Amazon Prime Video Channels, The Roku Channel, and Apple TV++.

Direct-to-consumer revenue constituted the majority of direct business revenue, expanding 4% to $31 million in 2024 and representing 81% of the direct business segment. However, this growth masked underlying subscriber retention challenges that became more pronounced in 2025.

The first indicators of subscriber fatigue emerged in 2024, as the total number of direct subscribers declined despite overall revenue growth and an a strong growth in US stream industry. This initial impact was temporarily offset by price increases implemented in 2023, though these proved to be an unsustainable growth mechanism. The deterioration accelerated in Q1 2025, with direct business revenue declining 9% year-over-year, primarily driven by a 10% decrease in direct-to-consumer business.

Conversely, partner direct revenue demonstrated resilience with a 54% increase in Q1 2025, benefiting from continued subscriber growth and the pricing adjustments. This growth partially offset the direct-to-consumer decline, though overall subscription counts decreased across all channels.

Content Strategy Limitations. The platform maintains a content library exceeding 3,000 premium factual titles, though only 900 represent exclusive originals. Since 2023, CuriosityStream has increasingly relied on barter trades for content acquisition rather than direct purchases, potentially limiting its ability to differentiate through exclusive programming.

Low pricing power. Direct subscription priced at low end relative to other streaming services. Curiosity Stream offers two monthly subscription plans: a Standard plan for $4.99 and a Smart Bundle plan for $9.99. Despite the low price, it continues to face difficult in attracting new direct subscribers.

Corporate demand has shown concerning trends, with enterprise customer agreements experiencing declining demand due to the expiration of certain corporate contracts. Additionally, deferred revenue downtrend patterns continue to suggest underlying subscription weakness, indicating potential challenges in customer acquisition and retention strategies.

Content Licensing

Encompasses revenue from traditional licensing arrangements, pre-sales of content, library sales to media companies, and the emerging high-growth area of AI training data licensing. This segment has evolved from simple content distribution to a sophisticated monetization strategy leveraging CuriosityStream's extensive factual content library.

Content licensing experienced extraordinary growth, surging 365% year-over-year in Q1 2025 to $5.4 million, representing 36% of total revenue. This dramatic expansion was primarily driven by new licensing agreements related to AI model training, involving both CuriosityStream's existing library content and partner content under revenue-sharing arrangements.

Management expects licensing revenue to exceed half of direct subscription revenue in 2025, fundamentally shifting the company's revenue profile. The company has secured agreements with hyperscalers and technology companies seeking hundreds of thousands of hours of video and audio content for generative AI training. Several international content licensing agreements has been signed with third-party broadcasters and streaming companies in 2Q25.

Revenue Recognition and Volatility Characteristics. The content licensing business exhibits inherent volatility due to its revenue recognition methodology, with 100% of contract value recognized upfront rather than pro-rata over time. These deals typically feature time-limited durations of 2-6 years based on market AI licensing standards. The additional revenue recognized in Q1 2025 could represent upfront payment on multi-year agreements, creating potential revenue timing fluctuations in future quarters.

CuriosityStream engages in barter transactions where content is exchanged without cash consideration. These arrangements are recorded as revenue at the estimated fair value of non-cash consideration received, with acquired assets recorded on the balance sheet and amortized over the content license term. This strategy enables content acquisition while preserving cash resources, though it may limit transparency in actual cash-generating capacity.

Bundled Distribution & Others

The bundled distribution segment operates through multi-year agreements with pay TV distributors, providing partners with 24/7 linear, on-demand, and mobile content access for fixed fees.

This segment faces significant headwinds due to ongoing disruption in the traditional television business and has not delivered material impact to overall business performance and is not expected to contribute meaningfully to future growth. The bundled distribution model reflects the broader industry challenges facing linear pay television providers, which are experiencing accelerated cord-cutting trends.

Others

The "Other" segment encompasses advertising revenue, sponsorships, enterprise solutions, educational courses, and events. Like bundled distribution, this segment remains relatively modest in its contribution to overall business performance and is similarly affected by traditional media industry disruption.

Industry Analysis

Streaming has reached a historic milestone, establishing itself as the dominant form of television consumption in the United States in 2025. In May 2025, streaming services captured 44.8% of total TV viewership—surpassing the combined share of broadcast television (20.1%) and cable (24.1%), which together represented 44.2% of viewing time. This marks the first time streaming has outpaced traditional television's combined audience, representing a 71% increase in streaming usage since May 2021.

The transformation has been particularly striking among key demographics. 70% of U.S. adults now select streaming services as their default viewing choice, while traditional television continues its decline with cable accounting for just 16.6% of default viewing preferences and broadcast only 4.9%. This shift reflects changing viewer habits, particularly among younger demographics who favor on-demand, personalized content experiences over scheduled programming

Subscription Video on Demand (SVOD) business strategies represent a fundamental departure from traditional television and film distribution models. Traditional linear television operates on mass audience aggregation principles, focusing on building and maintaining simultaneous viewer attention around single programs. This model requires networks to choose from numerous potential shows while attempting to predict which content will attract the largest concurrent viewership. The on-demand streaming paradigm transforms this equation entirely. The ability to serve programming on-demand enables platforms to pursue content that audiences will pay to access, rather than content designed purely for maximum simultaneous attention. This shift makes streaming services profoundly different from traditional television channels, as they can prioritize subscriber satisfaction over mass appeal and advertiser demands.

Global video streaming market size was valued at USD 674.25 billion in 2024 and is projected to grow at a CAGR of 18.5% between 2025 to 2032, from USD 811.37 billion in 2025 to USD 2,660.88 billion by 2032. The U.S. market specifically is projected to reach $610.59 billion by 2032. (Source: https://www.fortunebusinessinsights.com/video-streaming-market-103057)

Business models vary significantly among SVOD platforms, enabling the survival of smaller niche players without direct competition from larger services. The different value propositions offered by SVODs create space for both global mainstream services and specialized platforms targeting specific genres, demographics, or regional markets. Platforms can differentiate themselves across the entire streaming value chain—upstream (content acquisition and production), midstream (platform technology and user experience), and downstream (distribution and marketing strategies)

Key Financials

The business achieved positive adjusted operating cashflow margin as well as expanding ROIC since 2024. As of 1Q25, the adj operating cashflow margin was 18% and the adjusted annualized ROIC (adjusting the book value of produced content to replacement cost @$158K per hour benchmark) was 7%.

CuriosityStream maintains a strategically conservative capital structure with zero debt, positioning the company to navigate the inherent volatility of the streaming entertainment sector. The company ended Q1 2025 with $39.1 million in cash, restricted cash, and held-to-maturity securities, representing approximately one-third of its market capitalization and providing substantial financial flexibility.

Free operating cashflow was achieved through a significant reduction in addition of content assets and operating expenses. Specifically on content assets, since 2023, majority of the addition was done in the form of barter trade where it exchanges the rights with other content providers, meaning the additional content assets are not exclusive.

CuriosityStream is executing a fundamental strategic pivot from a direct-to-consumer subscription model toward content licensing as the primary revenue driver. Management expects overall licensing revenue to exceed half of direct subscription revenue in 2025, representing a dramatic shift in business mix that emphasizes higher-margin, less customer acquisition-dependent revenue streams.

Value Proposition

Direct Business: Losing its Competitive Edge.

SVOD success hinges on a compelling catalogue and a friction-free experience that persuades viewers to commit month-after-month. SVODs require audiences to decide if the catalog is valuable enough to make a monthly commitment upfront, which is a function of content and experience.

Netflix, for instance, built its moat by financing a vast slate of exclusive content, running its own global delivery infrastructure, and refining AI-driven personalization. Replicating that flywheel would require CuriosityStream—or any rival—to rebuild the platform from the ground up, an economically prohibitive task.

CURI had scaled back exclusive production, weak marketing and user-experience investment and gone five years without critical awards. Original commissioning has been replaced by barter transactions that merely swap non-exclusive programs, offering little incentive for new or existing subscribers to stay. CuriosityStream has limited investment in personalizing the interface or deepen viewer engagement contents and the last industry award dates to 2019, underlining the absence of headline-grabbing originals.

Early warning signs surfaced in 2024. Revenue ticked up only because of a 2023 price rise, even as subscriber numbers fell. Unless the company reverses course, a self-reinforcing spiral loom—shrinking fees reduce the budget for exclusive content, driving still more churn.

Content Licensing: An Emerging Opportunity with Question Marks.

CuriosityStream’s archival library may prove far more valuable to machines than to human viewers. Foundation-model developers and public-sector buyers are seeking large, high-quality factual datasets. Licensing from an established curator eliminates the time and cost of scraping, cleaning, and verifying open-web material, and can improve model accuracy, reduce bias, and confer differentiation.

Low-capital, high-margin. Management discloses gross margins of roughly 50%. Barter deals add hours at negligible cash cost, positioning the company as a content aggregator rather than a producer.

Proprietary factual archives of CURI’s deep factual information is unlikely to result in competition. Re-creating CuriosityStream’s 900-hour original library alone would cost an estimated US $36 million and take years—an unattractive proposition given the pace of AI development. Based on 1Q25, content licensing income was $3.7M, or $1.9M gross profit. If the term is 3 years, that’s $0.7m gross profit for 2025. Assuming the stream of income repeats for the next three quarters, that equals $2.8m in 2025, or 8% return. Yet building would require time and by the team the content is completed, uncertain how likely the demand from AI companies will be.

While factual content is long lived. long-term demand for premium factual content from AI companies remains highly uncertain. According to CreatE, majority of the 83 known license agreements were signed by just two AI companies and industry data shows that there are only a handful of major AI players, plus perhaps two-dozen mid-tier firms, that could be interested in acquiring the data. Using CuriosityStream’s Q1-2025 figure of US $3.7 million in incremental license revenue (≈US $1.8 million gross profit) recognized upfront and assuming 100% of it is from one of the 24 firms, even universal adoption by half of the 24 firms would yield about US $22 million one off gross profit.

AI training licenses may only pay once, even though the model can generate unlimited outputs inspired by the original content. Once an AI model is trained, the knowledge is embedded, making it difficult—sometimes impossible—for licensors to reclaim or control future use of their content.

There are indications which suggest mid to long term demand are uncertain. AI companies started acquiring license in 2023. Yet this has only been mentioned by management in 1Q25, indicating that the content could carries low desirability. While the management also indicates that content licensing revenue will exceed 50% of the direct business, it is unhelpful because (a) direct business is falling in revenue and (b) the basis for revenue recognition is different. Direct business is recognized pro-rata, yet content licensing revenue is recognized upfront.

Overall Business

The direct subscription business lacks the requisite content exclusivity, customer experience, and marketing muscle to fend off larger rivals, placing future revenue at risk. By contrast, the content-licensing arm enjoys high margins and low incremental cost, but its long-term scalability depends on still-nascent demand from a limited pool of AI customers.

Valuation

CuriosityStream lacks sustainable competitive moats. The company operates in two fundamentally different business segments: a declining direct subscription service devoid of competitive advantages and a content licensing operation characterized by high operational uncertainty and episodic revenue patterns.

Dividends unlikely to be sustainable long-term. The initial annualized dividend yield of 7% based on regular dividend of $0.32 and share price of $4.32. For the dividends to be sustainable, it would require $18m free cashflow each year, that’s significantly above the $2m quarterly operating cashflow generate in 1Q25 and would require content licensing to be sustainable long term.

Market seems overly optimistic. This valuation appears to embed overly optimistic expectations given the company's structural challenges and limited sustainable revenue visibility beyond short-term AI licensing contracts.

With no sustainable business moats, ROIC is unlikely to yield sufficient return for investors over the long term and liquidation value would be the most appropriate. The key adjustments needed would be in its content libraries on the book to liquidation value.

(a) Residual value of direct business with an estimated present value of $4M.

(b) Content Library Revision: The produced content assets warrant revaluation to approximately $100 million, representing roughly five times the estimated annual content licensing revenue and approximately 66% of the $150 million historically invested in originals, commissions, and co-productions as of Q2 2024. The liquidation value of the business (excluding potential synergy from next buyer) would be $145M, of which $40M belongs to cash / debt securities, resulting in a share price of $2.5, and in ROIC of 10% (excluding cash and debt securities).

Suggested entry of $1.9/share represents 30% margin of safety to the estimated liquidation value.

Disclaimer: This blog is a personal documentation of my own investing journey, thoughts, and experiences. It is intended solely for self-documentary purposes and general informational sharing. It does not constitute investment advice, financial recommendations, or personalized guidance. By reading this blog, you acknowledge that you are responsible for your own financial decisions and that the author assumes no liability for any actions taken based on the content herein.