Executive Summary

OneStream delivers a unified, no-code Finance SaaS platform for CFO offices, consolidating financial close, consolidation, planning, and analytics into a single cloud-native solution. Its hybrid pricing—mixing usage-based and platform fees—yields predictable Annual Recurring Revenue (90.6% of Q2 2025 revenue) and scalability. Professional services and perpetual licenses now represent only ~9% of total revenue.

OneStream operates within the Financial CPM sub-segment (12.5% CAGR between 2023-2028E) and stands to gain from a large migration runway as only 30% of ERP systems have moved to the cloud.

OneStream’s formidable business moats stem from its unified hybrid architecture, high switching costs, network effects through partner referrals and marketplace add-ons, and a sustained track record of R&D investment, collectively creating significant barriers to entry.

Project ARR to grow at a 17% CAGR from $568 million in 2024 to $1.7 billion by 2031E. This expansion reflects market share gains (from 5.2% to 9.9%), rising average contract values, and continued mid-market migration—further bolstered by FedRAMP certification.

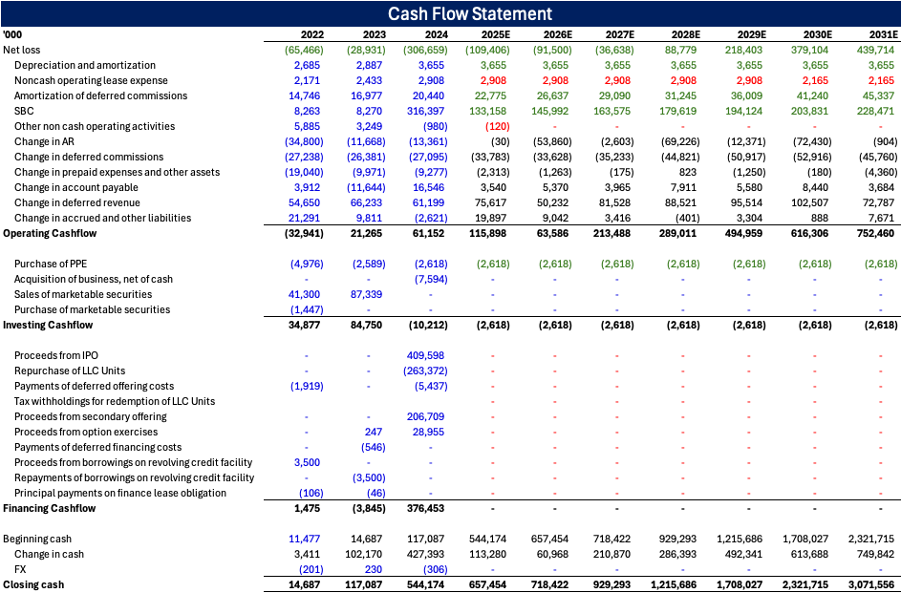

The balance sheet is healthy, with GAAP profitability expected by 2028E. Gross margins should remain in the 67–70% range, and while GAAP losses persist through 2027, a $652 million cash position and consistent positive free cash flow underpin strong financial flexibility.

Price target of $20 price implies fair value. Terminal value calculation was based on sustainable ROE assumptions in a high-barrier-to-entry market.

Bull case ($42): Accelerated mid-market penetration and 2× contract value growth.

Bear case ($13): Slower adoption and contract value increases in-line with inflation of 3%.

Business Model

OneStream is a Finance SaaS platform tailored for CFO offices, solving legacy finance challenges—namely the financial close, consolidation, and planning—through embedded AI, seamless integrations, and a no-code architecture.

The company’s cloud subscription offerings now drive the lion’s share of revenue: in Q2 2025, subscriptions represented 90.6% of total revenue, up from 87% in Q1 2025, reflecting customer migration from on-premises licenses to its AI-powered Finance Cloud.

Subscription. OneStream employs a hybrid pricing model that blends usage-based and platform-based fees, giving customers the elasticity to scale while preserving revenue visibility. The company’s average contract value stands at approximately $300,000, and list pricing for individual SaaS seats ranges from $200 to $660 per user per month, depending on functionality and volume. Typical contract terms span three years, though arrangements can vary from one to ten years to align with customer requirements.

Other revenue streams include license sales and professional services. As clients transition to the Finance Cloud, perpetual license sales have dwindled, comprising just 4% of total revenue. Meanwhile, professional services—which include implementation, consulting, and training—account for 5% of revenue, reflecting fees tied to onboarding and ongoing advisory support.

Sales channels. OneStream’s go-to-market strategy centers on a direct sales force augmented by a global network of 250+ implementation and development partners, including leading consultancies and technology alliances, to accelerate deployment and drive adoption.

Industry Analysis

The global Office of the CFO software market was valued at approximately €50 billion (roughly $54 billion) in 2023 and is projected to grow at a 13.1% CAGR to reach €100.4 billion ($100 billion) by 2028. This expansion is fueled by finance teams replacing manual, labor-intensive processes with automation, adopting advanced data visualization and analytics tools, and integrating AI to drive faster, more accurate decision-making.

This market comprises nine distinct sub-segments, each with its own dynamics and growth rates. – (1) Core financial management, (2) Financial CPM / Close & Strategic Planning, (3) AR & Invoice Automation, (4) Treasury Management, (5) Source-to-Pay Software, (6) Expense Management, (7) Tax Management, (8) Equity Management and (9) Corporate Secretary.

Equity management and tax management solutions are among the fastest-growing sub-verticals, reflecting increasing regulatory complexity and the need for specialized cap table and compliance tools, while Financial CPM / Close & Strategic Planning, the market which OneStream operates in is estimated to expand at 12.5% over the period, slightly below the market growth.

The CFO function remains in the early stages of a large digital transformation cycle. Only 30% of ERP systems currently reside in the cloud, leaving a sizeable migration runway as companies modernize their core finance platforms. Moreover, nearly 80% of CFOs plan to increase automation and digital technology investments in 2024 to enhance operational efficiency and insights. According to Grant Thornton’s Q1 2025 CFO survey, 49% of finance leaders have already prioritized cloud computing and storage among their top technology investments, underlining the shift from planning to implementation phases.

Current environment & migration window resets the competitive landscape. Traditionally dominated by on-premises legacy vendors with high switching costs, the CFO software market is witnessing a wave of displacement by pure-play, cloud-native providers. These modern platforms deliver AI-enabled capabilities, faster time-to-value, and seamless integrations, reshaping the competitive landscape and opening opportunities for nimble entrants to capture market share.

Value Proposition

OneStream differentiates itself by delivering a better, faster, and more cost-effective finance platform that displaces legacy systems and traditional, labor-intensive processes, meaning costs are also save from labor reduction.

OneStream’s concentrates on both the “close” (backward-looking) and “plan” (forward-looking) workflows—while bypassing adjacent processes such as transactional accounting, procure-to-pay, or revenue recognition. This contrasts with:

Legacy suites (e.g., Oracle, SAP, IBM) that offer end-to-end “record-to-report,” “plan-to-produce,” and “order-to-cash” process coverage but often suffer from lengthy implementations, high total cost of ownership, and functional bloat.

Point solutions (Anaplan on planning, BlackLine on reconciliation, Workday on core HCM/finance) that excel at a single workflow but leave customers with integration challenges and having too many vendors.

Traditional Challenges:

Mixed tech stacks. Difficulties in sourcing and integrating data from disparate systems.

Manual workflows. Labor intensive on low value task.

Prohibitive costs in terms of time cost and maintenance cost.

Vendor lock-in. Legacy players often try to build barrier of entry by forcing users to use the same software across all business activities.

Lack of real-time feeds.

How did OneStream reshape the industry?

Lowered implementation costs and short implementation time.

Streamlined, unified platform. Its single-architecture design consolidates financial close, consolidation, analytics, planning, and reporting into one cohesive solution. OneStream also integrates seamlessly with existing on-prem and cloud systems, making it ideal for data-rich organizations with fragmented infrastructures.

No-code, low-code deployment. The Genesis engine offers click-to-configure tools and a library of reusable dashboards, widgets, formulas, and workflows. CPM Express, OneStream’s prepackaged package for core CPM functions, enables customers to go live on planning, reporting, and close in just six to eight weeks, dramatically lowering implementation costs and time to value.

Broad ecosystem and extensibility. The OneStream Solution Exchange features turnkey add-ons from both OneStream and its partners to address specialized use cases—accelerating deployment and ensuring continuous innovation without vendor lock-in.

Embedded AI and automation. Building on its first ML-powered app in 2017, OneStream has continually expanded its AI suite—from predictive financial signaling in 2019 to the commercial release of Sensible ML in 2022—enabling finance teams to automate routine tasks, generate more accurate forecasts, and focus on strategic insights.

This "close-plus-plan" combination concentrates development and delivery on the two highest-value activities, creating a unique competitive moat while maintaining system simplicity.

Business Moats

Unified hybrid architecture that is difficult to replicate for both start-ups and legacy incumbents. By combining forward-looking planning with backward-looking consolidation and close, OneStream delivers a comprehensive, single-platform solution that is difficult for both greenfield start-ups and legacy incumbents to replicate.

Established vendors have often “lifted and shifted” on-prem code to the cloud. rebuilding full end-to-end capabilities would require multi-year, multi-hundred-million-dollar efforts.

Other conventional competitors such as Workday, BlackLine, and Anaplan serve adjacent niches and do not directly target the mid-market segment where OneStream has established its leadership. Their specialized offerings—Workday’s core ERP and HCM modules, BlackLine’s reconciliation suite, and Anaplan’s cross-departmental planning rarely displace OneStream in its sweet spot of companies seeking an all-in-one, end-to-end finance platform. E.g. for a “closing” software company, retrofitting a ledger-centric data store to support multi-dimensional, driver-based planning demands rewriting core platform components or layering a separate planning engine—both of which introduce architectural complexity, performance trade-offs, and integration friction.

High switching cost and implementation costs. Switching away from established systems exposes finance teams to forecasting errors and consolidation gaps—risks that far outweigh incremental subscription savings.

The fact that OneStream secured just a single customer at its 2012 inception and only reached ten customers by 2015 underscores the high barriers to entry inherent in the CFO software market.

Planful—the nearest comparable pure-play—achieved just $144 million ARR in 2025, less than one-third of OneStream’s scale, underscoring the difficulty of breaking into this space.

Network effects through the OneStream Solution Exchange (XF Marketplace) and a robust partner referral network. Each new deployment yields data and process insights that accelerate subsequent rollouts across the mid-market. As partners develop tailored connectors and add-ons, the cost and risk of switching to alternative platforms rise steeply.

Adverse selection should accelerate mid-market adoption. Companies resisting digital shift face escalating labor costs and strategic obsolescence if AI-driven forecasting proves indispensable.

Continue improvements create a moving target for smaller vendors to catch up. While OneStream continues to invest heavily in R&D, sales, and partner enablement—potentially compressing near-term margins—these expenditures further widen the capability gap, reinforcing its moat. The hybrid architecture, embedded AI roadmap, and partner ecosystem create a moving target that newcomers and retooled legacy vendors will struggle to hit without significant capital and multi-year technical rebuilds.

New entrants would need not only a solution markedly superior to existing offerings but also impeccable timing to achieve similar network effects of OneStream—an exceptionally difficult combination to replicate. Despite the steep barriers to entry evident in its early years, OneStream harnessed the momentum of the broader digital transformation to ignite its growth flywheel.

Growth Drivers

Annual recurring revenue is projected to expand at a 17% CAGR, rising from $568 million in 2024 to $1.7 billion by 2031E, driven by both organic account growth and deeper penetration within existing customers. This trajectory implies an increase in market share from 5.2% today to 9.9% by 2031.

Mid-market adoption to accelerate as the economics of replacing legacy platforms become increasingly compelling. With Oracle Hyperion support ending in 2031, many finance teams will be compelled to modernize. In 2023 and 2024, about two thirds of bookings was coming from legacy replacements.

Increase in average contract values from mid-market customers - boosted by cross-selling adjacent modules. Based on the table above, excluding the one-off implementation fees, contract value could be increased by 3x while remains competitive at the same time. I have modeled the value to grow by 1.5× by 2031 (versus 3× savings breakeven).

Since its primary competitive advantage is not in large enterprises, I have modeled it as minor increase in customers.

Modest growth in customer count with ARR > $1M, reflecting OneStream’s primary competitive advantage lies in mid-market segments. The potential FedRAMP opportunity—anchored by FedRAMP High certification—remains exploratory; although it validates platform security for public-sector adoption, its impact on ARR is modeled conservatively until tangible wins materialize.

Key Financials & Forecast

Revenue is projected to grow at a 17.5% CAGR from 2025E through 2031E, fueled primarily by a 19.5% CAGR in subscription sales.

Gross margins have held steady between 67% and 70% since 1Q22 (excluding one‐off stock-based compensation spikes). Cost of revenue (ex-SBC) is driven by third-party server and cloud storage expenses plus employee costs for support, implementation, and training. I expect margin ratios to remain in this band over the forecast period.

GAAP profitability remains elusive, with losses persisting through 2027E and breakeven on a GAAP basis only in 2028E. In 2Q25, sales & marketing and R&D consumed 48% and 23% of revenue, respectively typical for growth-oriented SaaS companies. Path to sustained profitability hinges on

ARR expansion

Moderating sales & marketing spend as payback periods shorten and

Unlocking operating leverage in R&D by spreading fixed costs across a larger user base

OneStream’s balance sheet is robust, with $652 million in cash (including $400 million raised at IPO) and no debt. Positive operating cash flow in 2023 and 2024 further underscores financial flexibility.

Annual free cash flow has been positive despite GAAP losses, primarily due to non-cash SBC charges and upfront billings under annual subscription contracts. As such, quarterly FCF margins have been volatile. Outstanding employee options represent $578 million of potential equity dilution.

Outstanding employee options represent $578 million of potential equity dilution.

Valuation & Scenario Analysis

A $20 per share target price values OneStream at current trading levels, reflecting a fair assessment of its growth and profitability potential. The terminal value assumptions presume a steady-state industry characterized by high barriers to entry, in which OneStream sustains elevated return on equity and requires minimal reinvestment to maintain its competitive advantages.

Bull Case ($42 / share): Assumes OneStream accelerates mid-market penetration from 2.3% in 2024 to 8.6% by 2031, capturing 21% of the CFO software market. In this scenario, average contract values double through cross-sell and upsell—versus a 1.5× increase in our base case—fueling outsized ARR growth and margin expansion.

Bear Case ($13 / share):Assumes modest penetration growth to 3.7% by 2031, reflecting competitive pressures and slower enterprise adoption. Contract values rise in line with 3% long-term inflation, limiting ARR upside and compressing valuation multiples.

Investment Risks

Macroeconomic uncertainty. Mid-market CFOs are "sensitive buyers," deal scrutiny increases during uncertain periods, as evidenced by Q4 2024 when some transactions were delayed due to tariff and trade concerns.

Path to profitability. If AI monetization fails to scale as expected or if the SaaS transition compresses margins more than anticipated, the timeline to profitability could extend significantly.

Technology and innovation risks. The rapid advancement of AI and automation threatens to commoditize core FP&A functionality, potentially eroding OneStream's product differentiation. The easy integration business moats could turn against OneStream. .

Disclaimer: This blog is a personal documentation of my own investing journey, thoughts, and experiences. It is intended solely for self-documentary purposes and general informational sharing. It does not constitute investment advice, financial recommendations, or personalized guidance. By reading this blog, you acknowledge that you are responsible for your own financial decisions and that the author assumes no liability for any actions taken based on the content herein.